E&S Tools and Resources

Environmental & Social Management (ESMS) System Diagnostic Tool for Financial Institutions (FIs)

The ESMS Diagnostic Tool for FIs is designed to enable IFC, FIs, institutional investors, and asset managers to assess or self-assess the quality of an ESMS and benchmark it against IFC's Performance Standard 1 and good market practices. The ESMS Diagnostic Tool assesses nine key elements of a financial institution's ESMS System and classifies them on the basis of their level of advancement.

Risk Categorization Table

Factors such as scale, location, sensitivity and magnitude of impacts of a project need to be considered on a case by case basis. For example, some hotel/tourism developments may be categorized as A, rather than B.

The examples of project categorization provided below are for illustrative purposes only.

Training

The IFC and other Development Finance Institutions offer training platforms on E&S risk management and environmental business opportunities.

IFC’s Sustainability Training & E-Learning Program (STEP):Designed for managers and staff of financial institutions (FIs), this e-training, available in English, French and Russian, represents the next generation of products designed to help financial institutions better understand sustainable finance, environmental and social risk management and explore sustainability-related business opportunities.

What is an ESMS?

A Environmental and Social Management System is a set of policies, procedures, tools and internal capacity to identify and manage a financial institution's exposure to the environmental and social risks of its clients/investees.

A Environmental and Social Management System states a financial institution’s commitment to environmental and social management, explains its procedures for identifying, assessing and managing environmental and social risk of financial transactions, defines the decision-making process, describes the roles, responsibilities and capacity needs of staff for doing so and states the documentation and recordkeeping requirements. It also provides guidance on how to screen transactions, categorize transactions based on their environmental and social risk, conduct environmental and social due diligence and monitor the client’s/investee’s environmental and social performance.

ESMS for Banking Institution

A banking institution's exposure to environmental and social risks varies greatly as a function of the clients within its portfolio and the types of financial transactions, which should be reflected in the scope of the ESMS.

The scope of financing activities of banking institutions may encompass transactions that target corporate finance, housing, project finance, retail, short-term finance, and small-medium enterprises.

ESMS for Leasing Company

The scope of financing activities of leasing companies encompasses transactions that vary in duration and consist of finance leases or operating leases of assets such as office equipment, vehicles, properties, and specialized equipment and machinery.

ESMS for Microfinance Institution

The scope of financing activities of microfinance institutions encompasses transactions that are of smaller amounts than those of banking institutions, focusing on commercial clients whose operations are generally small.

ESMS for Private Equity Fund

The scope of financing activities of private equity funds encompasses transactions that are direct equity investments in companies, generally for a fixed term, which are later sold in excess of the price initially paid for the investment.

Due to the legal nature of the transaction, which makes the private equity fund a partial or full owner of an investee company, the private equity fund is directly exposed to, and thus also liable for, the environmental and social risks of the investee company.

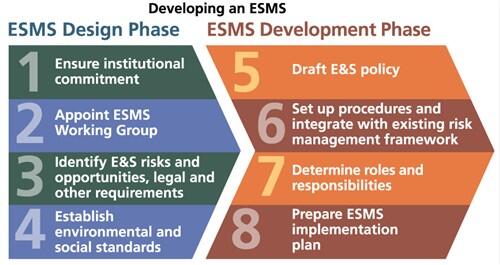

Developing an ESMS

Developing a ESMS requires senior management support and needs to be integrated with the financial institution's existing risk management framework.

Developing a ESMS is most effective and efficient if it is supported by senior management and integrated with the financial institution’s existing risk management framework. A financial institution can initiate the process for developing a ESMS by establishing a Working Group.

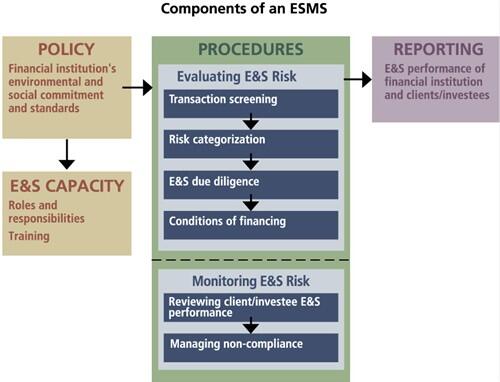

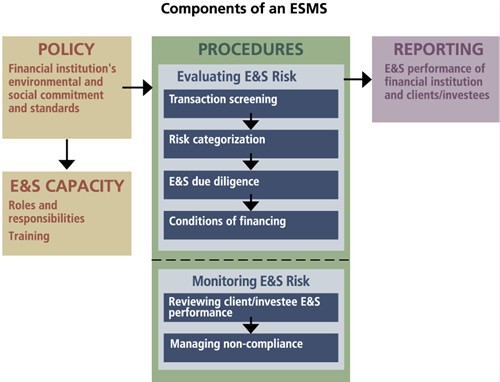

An ESMS includes a policy, a set of procedures to identify, assess and manage environmental and social risks in financial transactions and internal capacity of staff responsible for environmental and social management and investments.

Tips from Lessons Learned

Here are ten lessons for effective integration of sustainability into the policies, practices, products, and services of financial institutions.

Based on the experiences of financial institutions taking concrete steps to integrate sustainability into their policies, practices, products, and services, IFC’s report on Banking on Sustainability reveals the following 10 lessons for effective integration:

Initiate ESMS Development Process

A financial institution's internal process for developing a ESMS may vary based on its organizational characteristics. The process can be initiated by establishing an ESMS Working Group, which is responsible for developing the ESMS.

Tasks of ESMS Working Group

The ESMS Working Group should review the financial institution's exposure to environmental and social risk through its portfolio and develop the necessary procedures for evaluating and managing environmental and social risk.

To start the process of developing a ESMS, the ESMS Working Group should analyze the financial institution’s portfolio to gain an understanding of the financial institution’s exposure to environmental and social risk, including the industry sectors of clients/investees and transaction type.

Institutional Commitment

An ESMS can only function effectively and properly if its development and implementation is supported by the financial institution itself.

As with any other internal management system, an ESMS can only function effectively and properly if its development and implementation is supported by the financial institution itself. This requires ownership, dedication and commitment by the financial institution to allocate the necessary resources for the successful development of an ESMS.

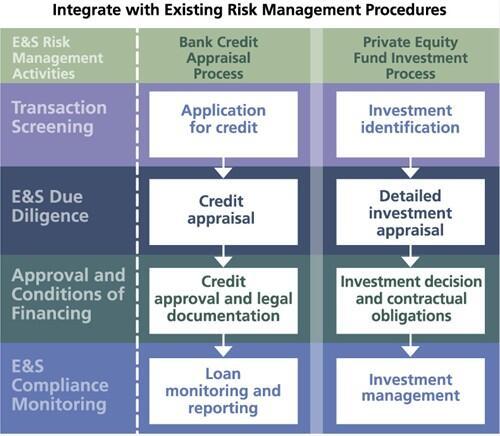

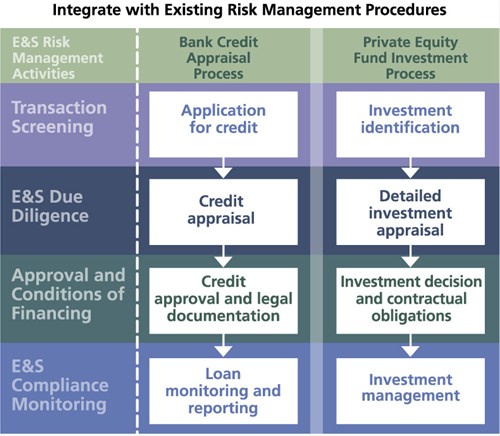

Integrate with Existing Risk Procedures

To be effective and cost-efficient, a financial institution's ESMS needs to be fully integrated into its existing risk management framework and it will be necessary to revise the existing procedures.

The procedures for managing environmental and social risk need to be applied in tandem with other risk management procedures already in place at each stage of the transaction cycle. To ensure this, a financial institution may need to revise the procedures that support its existing risk management framework by incorporating considerations for environmental and social risk throughout the transaction cycle or developing a stand-alone ESMS operations manual to formally document the environmental and social risk management process.

Documentation and Recordkeeping

Documentation and record-keeping on environmental and social issues associated with each transaction are a key aspect of an effective ESMS.

This enables a financial institution to track the environmental and social performance of each transaction and to assess the financial institution’ s overall exposure to risk. As part of a financial institution’s existing recordkeeping process, the following documentation and records should be kept for each transaction:

Guidance for Managing E&S Risk

To help ensure that the ESMS is effective, a financial institution may need to prepare additional guidance documents for staff to have a better understanding of environmental and social issues and how to manage them.

As necessary or as identified during the review and continuous improvement process of the ESMS, a financial institution may decide to prepare guidance documents on the following:

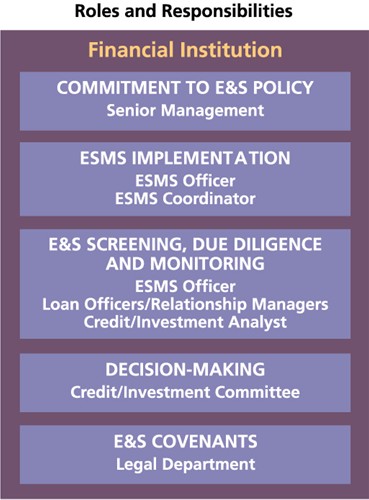

Roles, Responsibilities and Decision-Making

For a ESMS to function properly, it is essential that roles and responsibilities for carrying out the necessary procedures and making decisions are clearly defined.

Components of an ESMS

An ESMS is anchored in a financial institution's environmental and social policy and depends on the environmental and social management capacity of its staff and, as applicable, external experts.

The ESMS includes the financial institution’s environmental and social policy and designated roles and responsibilities of its staff.

E&S Policy

A environmental and social (E&S) policy states a financial institution's vision and mission with respect to the environment, society and contributions to sustainable development.

It is a short, written statement that articulates the financial institution’s commitment to integrating environmental and social considerations into its business activities as well as contributions to sustainable development. It serves as the financial institution’s foundation within which the objectives and procedures of the ESMS are anchored.

E&S Standards

Commensurate with the environmental and social risk associated with clients/investees in its portfolio, a financial institution should define environmental and social standards that establish the E&S requirements for transactions.

Risk Categorization and Managing Portfolio Risk

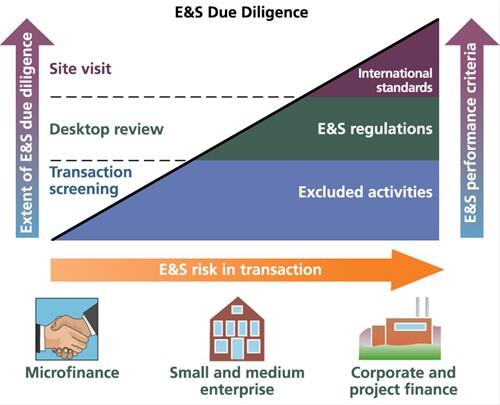

To help a financial institution to determine the extent of environmental and social due diligence that will be required for a particular transaction, a environmental and social risk category should be assigned to each transaction.

The level of environmental and social risk will vary greatly for different types of financial transactions and by industry sectors. It can also be determined by factors such as scale and location and magnitude of potential environmental and social impacts.

Transaction Screening

At the initial stage of evaluating a potential financial transaction, financial institution staff should screen the activities of the potential client/investee to determine if it is an excluded activity or if there is a history of severe incidents.

E&S Due Diligence

Conducting environmental and social (E&S) due diligence on transactions is a critical component of a financial institution's ESMS and its outcome should be factored in to the decision-making process for proceeding with a transaction.

Desktop Review

Financial institution staff can conduct a desktop review, which involves reviewing documentation concerning environmental and social matters as they relate to a proposed transaction and the technical aspects of a client's/investee's operations.

This includes verifying compliance of the business activities of a proposed client/investee against the relevant environmental and social regulations as well as international standards, as necessary.

Due Diligence for Corporate Finance

The environmental and social risks associated with a corporate finance transaction will vary and can be significant depending on the operation's industry sector, size, location, and company commitment and capacity to managing environmental and social risks.

Due Diligence for Housing Finance

The environmental and social risks associated with housing finance may include inappropriate development location, poor building design (including inability to withstand natural disasters), inadequate construction, and unresolved land tenure issues.

Due Diligence for Insurance

The environmental and social risks associated with insurance transactions range from being minimal to significant, as a function of a client's operations or the complexity of the project (such as roads, dams, and mining operations).

The procedures and tools for conducting environmental and social due diligence for an insurance transaction are described in a financial institution’s Environmental and Social Management System and should include the following steps as part of a desktop review and a site visit if necessary:

Due Diligence for Leasing

The environmental and social risks associated with leasing activities are generally minimal for most transactions but will be more significant if the fixed asset involves the use of heavy equipment and as a function of the industry sector.

The procedures and tools for conducting environmental and social due diligence for leasing activities are described in a financial institution’s Environmental and Social Management System and should include the following steps as part of a desktop review and a site visit, if necessary:

Due Diligence for Microfinance

The environmental and social risks associated with a microfinance transaction are typically low partly due to the small size of the operation and the industry sector.

The procedures and tools for conducting environmental and social due diligence for microfinance are described in a financial institution’s Environmental and Social Management System.

Due Diligence for Project Finance

Due to the complexity, size, and location of operations such as roads, oil and gas explorations, dams, and power plants, which are financed as projects, these projects often have challenging environmental and social issues.

Challenging environmental and social issues may include involuntary resettlement, loss of biodiversity, impacts on indigenous communities, community and worker safety, pollution, contamination, and others. The life cycle of such projects generally includes several phases such as construction, operations, and decommissioning and typically extends over many years.

Due Diligence for Retail

The environmental and social issues associated with retail transactions that target individuals are generally non-existent.

However, for retail transactions there may be concerns associated with housing mortgage finance and potentially certain investment options that may involve controversial or high-risk projects/companies.

Due Diligence for Short-Term Finance

The environmental and social issues associated with a short-term finance transaction range from minimal to complex and vary according to size, industry sector, location, and company commitment to managing environmental and social risks.

Due Diligence for Small/Medium Enterprises

The environmental and social issues associated with financing small and medium enterprises can be quite significant and are primarily related to worker health and safety and pollution.

Generally, the environmental and social issues of small and medium enterprises are not closely monitored and the risks will vary depending on company size and its capacity to manage environmental and social risks, as well as by industry sector, and location.

Due Diligence for Trade Finance

The environmental and social risks of trade finance are associated with the production of those goods being traded and vary by industry sector and location.

The procedures and tools for conducting environmental and social due diligence for trade finance are described in a financial institution’s Environmental and Social Management System.

Corrective Action Plan

Financial institution staff may develop a corrective action plan with a timeframe for the client/investee to implement appropriate mitigation measures to comply with the financial institution's environmental and social requirements.

Depending on the nature of environmental and social risks associated with a client’s/investee’s operations, financial institution staff may develop a corrective action plan with a timeframe for the client/investee to implement appropriate mitigation measures to comply with its environmental and social requirements. The purpose of a corrective action plan is to mitigate potential environmental and social risks in the context of a transaction to an acceptable level for the financial institution.

E&S Covenants in Legal Agreements

Environmental and social (E&S) clauses can be incorporated into legal agreements with clients/investees. This helps reduce a financial institution's exposure to potential environmental and social risks associated with a client's/investee's.

Financial institution staff can incorporate environmental and social clauses into legal agreements with clients/investees to require clients/investees to comply with the financial institution’s environmental and social requirements. Doing so helps a financial institution reduce its exposure to the environmental and social risks associated with a client’s/investee’s operations throughout the lifetime of a transaction and gives the financial institution legal recourse in the case of non-compliance.

Monitoring Client/Investee E&S Performance

The purpose of monitoring a client's/investee's environmental and social performance is to assess existing and emerging environmental and social risks associated with a client's/investee's operations during the duration of a transaction.

Once a transaction has been approved, the financial institution needs to monitor the client’s/investee’s ongoing compliance with the environmental and social clauses stipulated in the legal agreement. Environmental and social risks or compliance status may change from the time of transaction approval.

Managing Non-Compliance

In cases of a client's/investee's non-compliance with the financial institution's environmental and social standards that are stipulated in the legal agreement, the client/investee will have a timeframe for resolving the issue.

During monitoring, financial institution staff may identify environmental and social issues, such as a client’s/investee’s non-compliance with one or more of the clauses stipulated in the legal agreement.

Internal and External Reporting

A financial institution's ESMS should include periodic reporting on the environmental and social performance of transactions and measures taken to reduce its overall exposure to environmental and social risk.

Financial institution staff should compile all environmental and social findings from monitoring clients/investees and aggregate findings at the portfolio level. By analyzing this information, the financial institution can have a better understanding of its overall exposure to environmental and social risk through its portfolio.

Implementing an ESMS

Once the ESMS has been developed and formally approved by Senior Management, it can be institutionalized and rolled out across the financial institution.

Once the ESMS has been developed and formally approved by Senior Management, it can be institutionalized and rolled out across the financial institution.

Assign ESMS Responsibilities

The ESMS lists the roles and responsibilities needed for effective implementation of environmental and social risk management procedures.

Additional responsibilities for environmental and social risk management should be assigned to existing staff or new staff should be hired as required by the ESMS.

ESMS Review and Continuous Improvement

The ESMS should be updated regularly to reflect any changes in the environmental and social regulations and/or international best practices that affect the business operations of a financial institution's clients/investees.

ESMS Testing Phase

The ESMS should be implemented gradually, starting with a pilot test phase with limited application (for example, at one branch or limited to a specific sector or a certain aspect of the financial institution's financial activities).

Internal Communication and Training

The purpose of the ESMS and its supporting procedures should be communicated to all staff of a financial institution. This can be achieved through an office memo or emails, staff meetings, newsletters, presentations and seminars.

Review E&S Regulatory Framework

A financial institution needs to be knowledgeable of the environmental and social laws of the country in which it operates, to be able to verify how its commercial clients/investees comply with applicable environmental and social laws, which vary by country.

As part of its environmental and social due diligence process, a financial institution may verify how its commercial clients/investees comply with applicable environmental and social laws, which vary by country.

IFC E&S Requirements

IFC requires financial institution (FI) clients to manage environmental and social risks in their portfolio while encouraging them to expand product offerings into financing/lending to sustainable energy projects.

Sustainability is about ensuring long-term business success while contributing toward economic and social development, a healthy environment, and a stable society. IFC’s definition of sustainability as applied to financial institutions encompasses the following dimensions of good business performance:

Implementing IFC E&S Requirements

The International Finance Corporation (IFC) strives for positive development outcomes in the private sector projects - including financial institutions - it finances.

Designate an ESMS Officer

The financial institution is required to nominate an officer to serve as the person with the responsibility of overall administration and oversight for the implementation of the ESMS.

Establish and Maintain an ESMS

A financial institution is required to establish a Environmental and Social Management System to manage risks in a manner consistent with IFC's Policy on Environmental and Social Sustainability and IFC's Environmental and Social Review Procedure.

Develop an ESMS

A financial institution may be required to develop a Environmental and Social Management System to identify and manage the risks and impacts associated with its financing activities.

Based on IFC’s review, a financial institution may be required to develop a Environmental and Social Management System (ESMS) to manage the risks and impacts associated with its financing activities in order to ensure that these comply with the IFC Exclusion List, applicable national environmental and social regulations and the IFC Performance Standards.

Enhance an Existing ESMS

Based on IFC's review, a financial institution may be required to enhance its existing risk management procedures for assessing environmental and social risks and meet IFC's standards

Based on IFC’s review, a financial institution may be required to modify its existing risk management procedures for assessing environmental and social risks to meet IFC’s standard for a Environmental and Social Management System (ESMS) as well as applicable IFC environmental and social performance requirements. To enhance its existing capacity for managing environmental and social risks, the financial institution may be required to:

IFC E&S Performance Requirements

The financial institution's Environmental and Social Management System should be designed to manage and reduce its overall exposure to environmental and social risk.

Applicable National E&S Laws

The non-compliance of a commercial client/investee with applicable environmental and social laws may present a potential risk to the financial institution.

To manage the risk associated with non-compliance of a commercial client/investee with applicable environmental and social laws, financial institutions should avoid financing a commercial client/investee whose activities do not comply with applicable national environmental and social laws unless the client/investee agrees to a corrective action plan.

IFC Exclusion List

The IFC Exclusion List defines the types of projects that IFC does not finance, either directly or indirectly through financial institution clients.

IFC Performance Standards

When the potential environmental and social impacts associated with a financial institution's client/investees are significant, the financial institution should apply the IFC's Performance Standards as a benchmark for identifying and managing these risks.

The IFC Performance Standards are an international benchmark for identifying and managing environmental and social risk and has been adopted by many organizations as a key component of their environmental and social risk management. IFC’s Environmental, Health, and Safety (EHS) Guidelines provide technical guidelines with general and industry-specific examples of good international industry practice to meet IFC’s Performance Standards.

IFC E&S Requirements for FI Clients

By applying a comprehensive set of environmental and social performance standards to projects, IFC expects to achieve environmental and social sustainability, which represents an important component of positive development outcomes of projects.

Through its Policy on Environmental and Social Sustainability, IFC puts into practice its commitment to environmental and social sustainability. This commitment is based on IFC’s mission and mandate, which is to promote sustainable private sector development in developing countries, helping to reduce poverty and improve people’s lives. IFC believes that sound economic growth, grounded in sustainable private investment, is crucial to poverty reduction. Translating this commitment into successful outcomes depends on the efforts of IFC and its clients.

Report Annually

All IFC clients including financial institutions are required to report to IFC on an annual basis on their environmental and social performance from disbursement until the end of the IFC investment.

Reporting for Banking Institutions

Banking institutions that are IFC clients are required to report to IFC on an annual basis on their environmental and social performance by submitting an Annual Environmental Performance Report (AEPR).

As part of IFC’s annual reporting requirements, Banking Institutions are required to provide information on:

Reporting for Leasing Companies

Leasing Companies that are IFC clients are required to report to IFC on an annual basis on their environmental and social performance by submitting an Annual Environmental Performance Report (AEPR).

As part of IFC’s annual reporting requirements, Leasing Companies are required to provide information on:

Reporting for Microfinance Institutions

Microfinance institutions that are IFC clients are required to report to IFC on an annual basis on their environmental and social performance by submitting an Annual Environmental Performance Report (AEPR).

As part of IFC’s annual reporting requirements, Microfinance Institutions are required to provide information on:

Reporting for Private Equity Funds

Private equity funds that are IFC clients are required to report to IFC on an annual basis on their environmental and social performance by submitting an Annual Environmental Performance Report (AEPR).

As part of IFC’s annual reporting requirements, Private Equity Funds are required to provide information on:

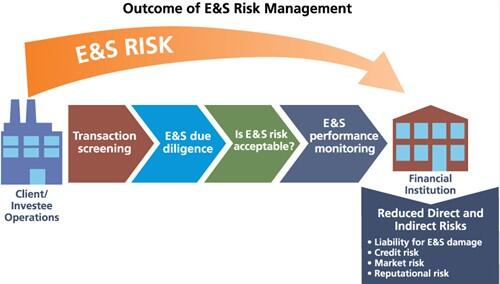

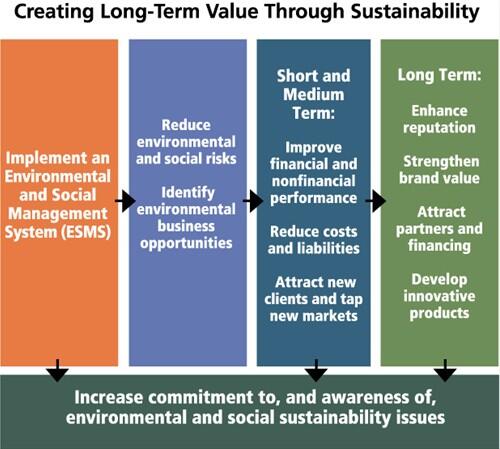

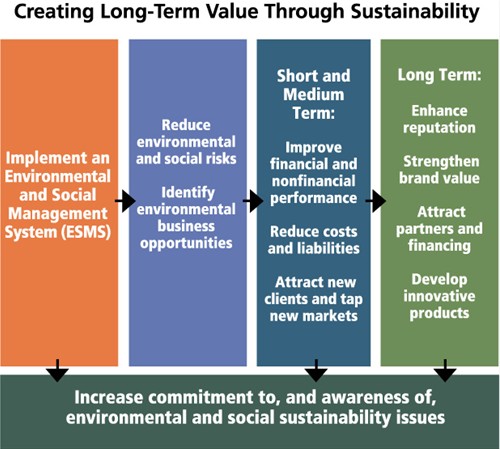

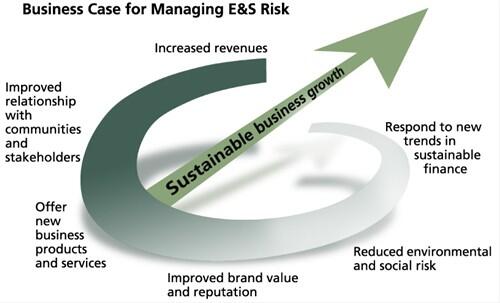

Business Case for Managing E&S Risk

Considering environmental and social risks as part of the risk appraisal process for transactions helps a financial institution to decrease its exposure to overall risk and contributes to its long-term financial viability.

A financial institution can do so by developing a Environmental and Social Management System, which can be integrated into its existing risk management framework including the risk appraisal process for transactions. A well-developed Environmental and Social Management System can lead to decreased exposure to environmental and social risks, increased market opportunities, and enhanced reputation, which help contribute to the long-term financial viability of financial institution.

Addressing E&S Risk

Understanding and managing environmental and social risks is becoming increasingly recognized as an important element of a financial institution's approach to risk management.

Benefits of Addressing E&S Risks

Environmental and social risk management benefits a financial institution by improving overall risk management, identifying new environmental business opportunities, and adding value to clients and investees, thus gaining a competitive advantage.

More and more financial institutions are now convinced that environmental and social risks of clients need to be considered and that this can be done effectively by incorporating environmental and social risk into risk management processes.

Better Risk Management

Financial institutions are directly exposed to credit, liability and reputational risks arising from E&S issues associated with their clients'/investees' operations.

Competitive Advantage

Good governance, accountability and increased lender liability are relevant to financial institutions. Clients/investees are starting to look at a financial institution's position on environmental and social issues when deciding where to take their business.