Site Visit

Financial institution staff can conduct a site visit to gain an impression of the environmental and social issues associated with the daily operations of a client's/investee's business. This provides insight into potential environmental and social risks.

Financial institution staff can conduct a site visit as part of the environmental and social due diligence process for a proposed transaction as well as during the monitoring process for an approved transaction.

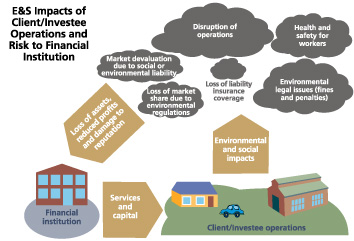

FI's Exposure to E&S Risk

A client's/investee's exposure to environmental and social risk involves the potential of an adverse event that may have implications for the client/investee and may jeopardize its financial and operational viability.

Client/investee activities may cause environmental impacts, present a hazard to human health, or could negatively affect the surrounding community as a result of improper planning or management.

Banking Institution

A banking institution (also referred to as a universal or commercial bank) can range from a large financial institution with a highly visible brand name and an international presence to a small organization with a local presence.

Leasing Company

A leasing company provides a physical asset or service for use by a commercial client or individual for an established period of time in return for regular payments, known as financial leasing.

Microfinance Institution

Microfinance institutions are organizations that provide loans to low-income clients, including micro-companies and the self-employed, who traditionally lack access to mainstream sources of finance from Banking Institutions.

Private Equity Fund

Private equity funds make long-term equity investments in companies or projects (although sometimes other financial instruments may be used) with the goal of later selling the equity stake at a profit at the time of exit.

E&S Issues

Environmental and social issues may manifest in many different ways and affect the viability of a financial institution's client/investee operations.

Air Emissions and Air Quality

Emissions of air pollutants can occur from a wide variety of activities during construction, operation and decommissioning of a client's/investee's operations.

Biodiversity and Natural Resources

Land use and conversion to support a client's/investee's operations not only results in increased erosion of the topsoil but can also impact biodiversity due to habitat loss and fragmentation.

Land use and conversion to support a client’s/investee’s operations not only results in increased erosion of the topsoil, which leads to sedimentation of streams and rivers and degrades water quality, but can also impact biodiversity due to habitat loss and fragmentation. A reduction in biodiversity diminishes the capacity of ecosystems to provide a stable and sustainable supply of essential goods and services such as clean air and water and also reduces genetic variability, which could potentially decrease the amount of natural resources available for future use.

Community Health, Safety and Security

A client's/investee's operations can increase the potential for community exposure to risks and impacts arising from accidents, structural failures, and releases of hazardous materials

A client’s/investee’s operations often bring benefits to communities including employment, services, and opportunities for economic development. However, these operations can also increase the potential for community exposure to risks and impacts arising from accidents, structural failures, and releases of hazardous materials. Communities may also be affected by impacts on their natural resources, exposure to diseases, and the use of security personnel.

Cultural Heritage

Cultural heritage encompasses properties and sites of archaeological, historical, cultural, artistic and religious significance as well as unique environmental features and cultural knowledge, and practices of communities protected for future generations.

Energy Use and Conservation

A client's/investee's operations consume energy to power processes such as heating and cooling; auxiliary systems such as motors, pumps and fans; generating compressed air; heating, ventilation and air conditioning systems (HVAC); lighting systems or other industry-sector specific processes.

Hazardous Materials Use

A client's/investee's operations may require the use of materials that are hazardous. Hazardous materials are materials that represent a risk to human health, property, or the environment due to their physical or chemical characteristics.

These can be classified according to the hazard as explosives; compressed gases, including toxic or flammable gases; flammable liquids; flammable solids; oxidizing substances; toxic materials; radioactive material; and corrosive substances.

Indigenous Peoples

Indigenous Peoples (IPs) are recognized as social groups with identities that are distinct from dominant groups in national societies and are often among vulnerable segments of the population.

Indigenous Peoples may be referred to in different countries by such terms as “Indigenous ethnic minorities”, “aboriginals”, “hill tribes”, “minority nationalities”, “scheduled tribes”, “first nations”, or “tribal groups”.

Labor and Working Conditions

The pursuit of economic growth through employment creation and income generation should be balanced with protection for basic rights of workers.

For any business, the workforce is a valuable asset, and a sound worker-management relationship is a key ingredient to the long-term sustainability of the enterprise. Failure to establish and foster a sound worker-management relationship can undermine worker commitment and retention, result in labor strikes, and can jeopardize a client’s/investee’s operations. Conversely, through a constructive worker-management relationship, and by treating the workers fairly and providing them with safe and healthy working conditions, clients/investees may create tangible benefits, such as enhancement of the efficiency and productivity of their operations.

Land Acquisition and Resettlement

Involuntary resettlement refers both to physical displacement and to economic displacement due to land acquisition associated with a client's/investee's operations.

Involuntary resettlement refers both to physical displacement (relocation or loss of shelter) and to economic displacement (access to resources for income generation or means of livelihood) due to land acquisition (including rights-of-way) associated with a client’s/investee’s operations. Resettlement is considered involuntary when affected individuals or communities do not have the right to refuse displacement. This occurs in cases of: i) lawful expropriation or restrictions on land use based on eminent domain; and ii) negotiated settlements in which the buyer can resort to expropriation or impose legal restrictions on land use if negotiations with the seller fail.

Land Contamination

Land can become contaminated due to releases of hazardous materials, wastes, or oil, including naturally occurring substances.

Releases of these materials may be the result of historic or current site activities, including accidents during their handling and storage, or due to poor management or disposal. Land is considered contaminated when it contains hazardous materials concentrations, including oil, above baseline and/or naturally occurring levels.

Occupational Health and Safety

Providing workers with a safe and healthy work environment, free from physical, chemical, biological, and radiological hazards inherent in a particular industry sector, is essential for ensuring the long-term sustainability of a client's/investee's operations.

Wastes

A client's/investee's operations may generate, store, or handle any quantity of hazardous or non-hazardous waste across a range of industry sectors.

Waste can be solid, liquid, or contain gaseous material that is discarded by disposal, recycling, burning or incineration. It can be a by-product of a manufacturing process or an obsolete commercial product that can no longer be used for its intended purpose and requires disposal. Inappropriate waste disposal practices can lead to contamination of ground water or potential fines and/or penalties as stipulated in national regulations.

Wastewater and Water Quality

A client's/investee's operations generate wastewater, which is treated on site and/or discharged either to the municipal sewage system for treatment or directly to the environment (surface water) without prior treatment.

Water Use and Conservation

A client's/investee operations use water in various production processes, which vary by industry sector. Typically, water use at the facility level is associated with processes such as described here.

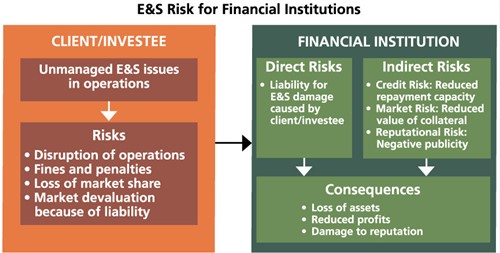

E&S Risk for Financial Institutions

The operations of a financial institution do not generate significant environmental and social impacts, but the way their clients/investees manage impacts of their operations may pose risks to a financial institution.

Client/investee operations may also represent opportunities for additional financing and growth. All financial institutions are exposed to some level of environmental and social risk through their clients/investees. If left unmanaged, these risks can lead to a decline in the financial institution’s reputational image, costly litigation, or loss of revenue.

Risk in Corporate Finance

Corporate transactions typically consist of loans to, or investments in, commercial operations of different sizes and operating in a variety of industry sectors.

Loans (debt) can be used by the commercial operation to finance a specific aspect of the operation, such as the purchase of equipment, or for renovation/expansion of the operation. Equity investments in a commercial operation provide operating capital for an operation in exchange for shares (equity) in the company/project.

Risk in Housing

This type of financing generally involves providing mortgage loans directly to consumers for the specific purpose of financing the purchase of a home.

In this type of transaction, the financial institution becomes the legal owner of the property during the repayment duration of the mortgage.

Risk in Insurance

Many financial institutions sell insurance policies to clients, which involves agreeing to cover the potential costs associated with an event that meets pre-established requirements in exchange for the regular payment of a premium to the financial institution.

Risk in Leasing

In a leasing transaction, the use of a fixed asset or service is provided in return for regular payment by the user (the lessee) under the lease contract.

Fixed assets that can be leased typically include light equipment (such as passenger cars, light duty trucks, office equipment, furniture, and appliances,) or heavy equipment (such as earth movers, large machines, industrial equipment, cargo vessels, heavy duty trucks, and airplanes). In some cases, Leasing Companies can own, maintain and operate the leased physical assets, known as operational leasing. In other cases, Leasing Companies simply provide the necessary financing to lessees, known as financial leasing.

Risk in Microfinance

Microfinance institutions provide financial services, such as loans, to low-income clients, including micro-companies and the self-employed, who traditionally lack access to finance.

These transactions are typically of smaller amounts and shorter tenure than corporate loans and target small business owners or commercial clients whose operations are generally small.

Risk in Project Finance

Project finance transactions typically involve the direct financing of infrastructure and industrial projects.

The financing is usually secured by the project assets such that the financial institution providing the funds will assume control of the project if the sponsor has difficulties complying with the terms of the transaction.

Risk in Retail

Retail transactions include financial services such as deposits (checking and savings accounts) and credit cards as well as personal loans such as mortgage and vehicle finance.

Environmental and social issues associated with retail transactions that target individuals are generally non-existent, although there may be concerns associated with mortgage finance and potentially certain investment options that may involve controversial or high-risk projects/companies.

Risk in Short-Term Finance

Short-term finance involves providing loans with a term of a few months or less, but no longer than a year.

Short-term finance, such as trade finance, often involves collateral such as accounts payable or inventories. A company will pledge or sell its receivables to the creditor in exchange for immediate cash (also called factoring). While certain corporate loans and types of project finance usually target a specific purpose such as construction or purchase of equipment, short-term loans such as working capital loans, are usually for general purposes and support the general business operations of a company.

Risk in Small and Medium Enterprises

Although less complex than for large corporate and project investments, the environmental and social issues associated with small and medium enterprises can be significant and are primarily related to worker health and safety and pollution.

Risk in Trade

Trade financing involves providing financial products to enable importers and exporters to trade across national borders and is generally done through banks, credit agencies, insurers, forfeiters or other institutions.

E&S Risk by Industry Sector

Clients/investees operate in a variety of industry sectors with a range of environmental and social risks. A preliminary risk assessment can be conducted based on the sector of operation.

Industry-specific environmental and social guidelines have been developed to assist both clients/investees and financial institutions to better understand and manage environmental and social risks in their operations.