Sustainable Banking and Finance Network (SBFN)

Established in 2012, the Sustainable Banking and Finance Network (SBFN) is a voluntary community of financial sector regulators, central banks, ministries of finance, ministries of environment, and industry associations from emerging markets committed to advancing sustainable finance and responsible investment for national development priorities, financial market deepening, and stability.

Sustainable Banking and Finance Network Meetings

The SBFN Global Meetings hosted since 2012 are the principal space for dialogue, networking and knowledge generation among SBFN members. These meetings provide SBFN members with a platform from which to showcase national and regional initiatives in the sustainable finance space, and to explore approaches from different markets. Furthermore, these meetings provide the opportunity to discuss current issues and jointly develop new approaches to sustainable banking.

Sustainable Banking Guidance from SBFN Members

As of November 2021, 33 SBFN countries had launched over 200 national framework documents to support sustainable finance. The process of developing and implementing these frameworks generates a positive dynamic between the public and private sector, enabled by SBFN’s mix of both regulators and industry associations. This is seen in the mix of market-based actions and policy leadership that is resulting in more effective frameworks and implementation.

Sustainable Banking and Finance Network - Contact Information

The secretariat of the Sustainable Banking and Finance Network is hosted by the International Finance Corporation.

Please contact us for additional information, questions and feedback.

Rong Zhang

Senior Policy Officer

Environment, Social and Governance Department

International Finance Corporation

2121 Pennsylvania Ave., NW

Washington, DC 20433

E-mail:

rzhang [at] ifc.org (rzhang[at]ifc[dot]org)

sbn [at] ifc.org (sbn[at]ifc[dot]org)

Sustainability Frameworks

Investors are increasingly realizing that environmental, social and corporate governance issues can impact the performance of investment portfolios. Sustainability frameworks have been developed to help organizations manage these issues.

Equator Principles

The Equator Principles are a voluntary set of environmental and social guidelines for project finance lending.

They provide a framework for financial institutions to manage environmental and social issues related to projects they finance anywhere in the world and to all industry sectors, including mining, oil and gas, and forestry. The Equator Principles are based on IFC’s Performance Standards and apply to projects that exceed $10 million.

United Nations Financial Initiative

In recognition that the financial sector has a valuable contribution to make in protecting the environment while maintaining the health and profitability of their businesses, the United Nations Environment Programme (UNEP) joined forces with a group of commercial banks and launched the Banking Initiative.

United Nations Principles for Responsible Investment

In 2005, 20 institutional investors from 12 countries accepted an invitation from the Secretary General of the United Nations to participate in an Investor Group to jointly develop the Principles for Responsible Investment (PRI).

Supported by experts from the investment industry, governmental organizations, civil society and academia, the Investor Group formulated the following principles:

Sustainability Reporting

Communicating a financial institution's performance in sustainability initiatives and environmental and social management is a key component in creating long-term value.

Paris Agreement

What is Paris Agreement

The Paris Agreement (PA) is a legally binding international treaty on climate change. It was adopted by 196 Parties at COP 21 in Paris, on 12 December 2015 and entered into force on 4 November 2016. Since then, 197 countries – nearly every nation on earth – have endorsed the Paris Agreement.

Why Paris Agreement Matters

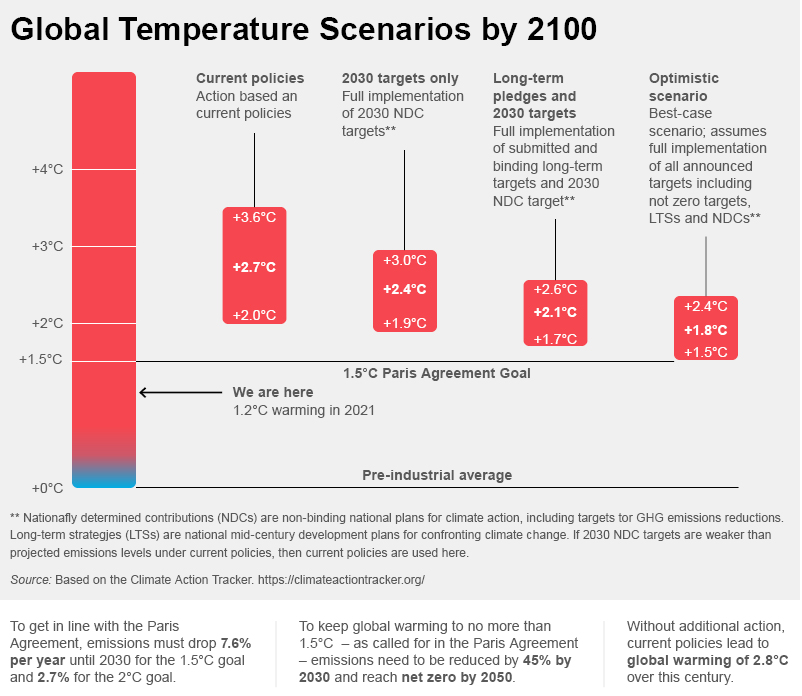

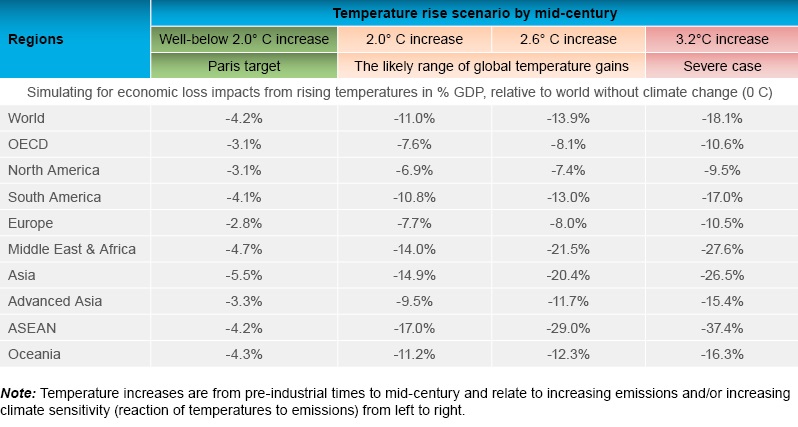

Global temperature rises will negatively impact GDP in all regions by mid-century. The current trajectory of temperature increases, assuming action with respect to climate change mitigation pledges, points to global warming of 2.0–2.6°C by midcentury. The loss in global economic value in this scenario could be up to 10% higher than if the Paris Agreement of much less than 2°C rise in temperatures is reached. Economies in southeast Asia (ASEAN) countries would be hardest hit. In a severe scenario of a 3.2°C-rise in temperatures, the global GDP loss could be as much as 14% higher than that under the Paris targets.

Source: Swiss Re Institute: The economics of climate change: no action not an option

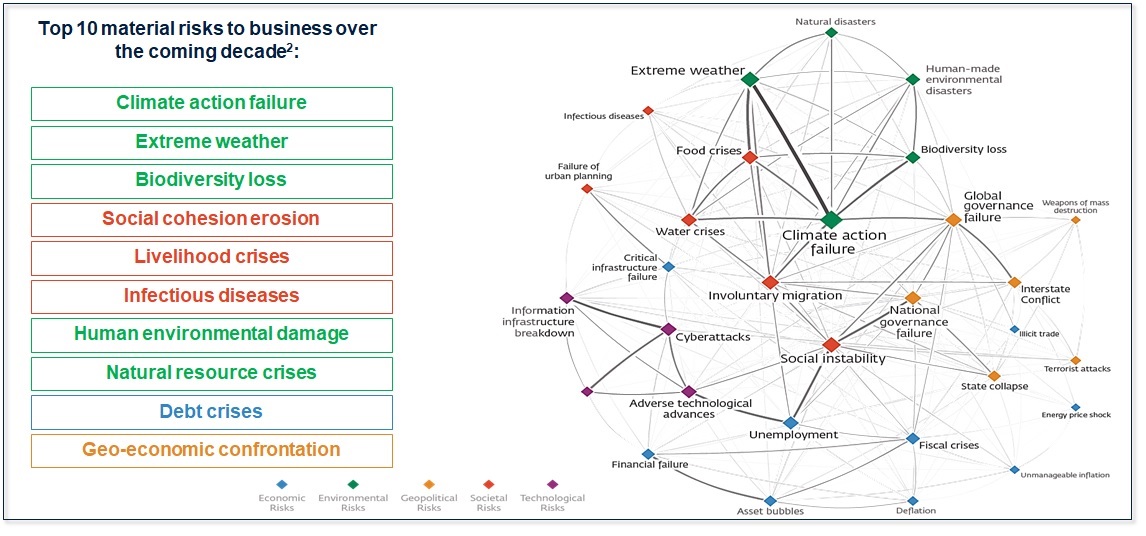

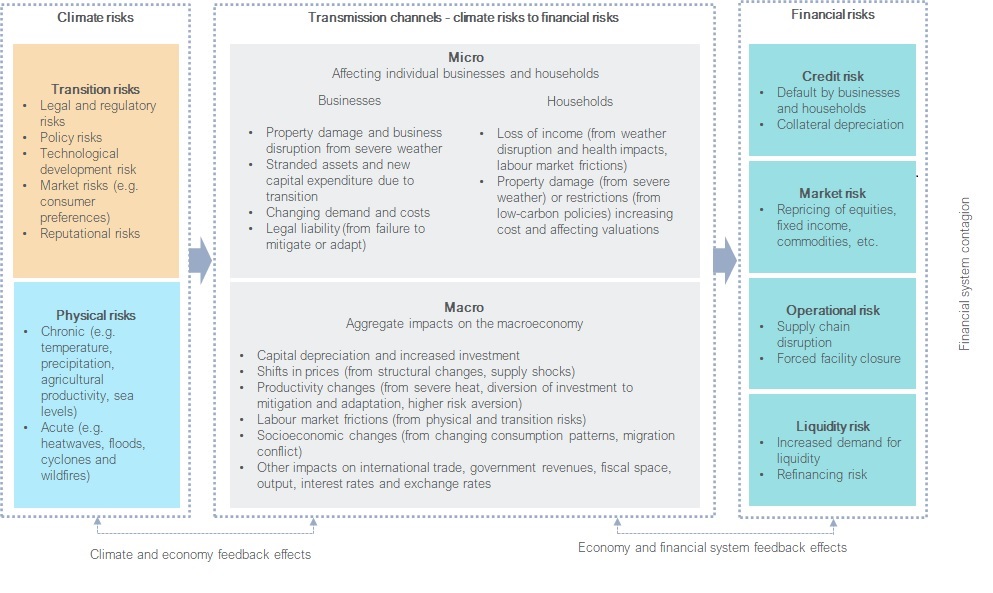

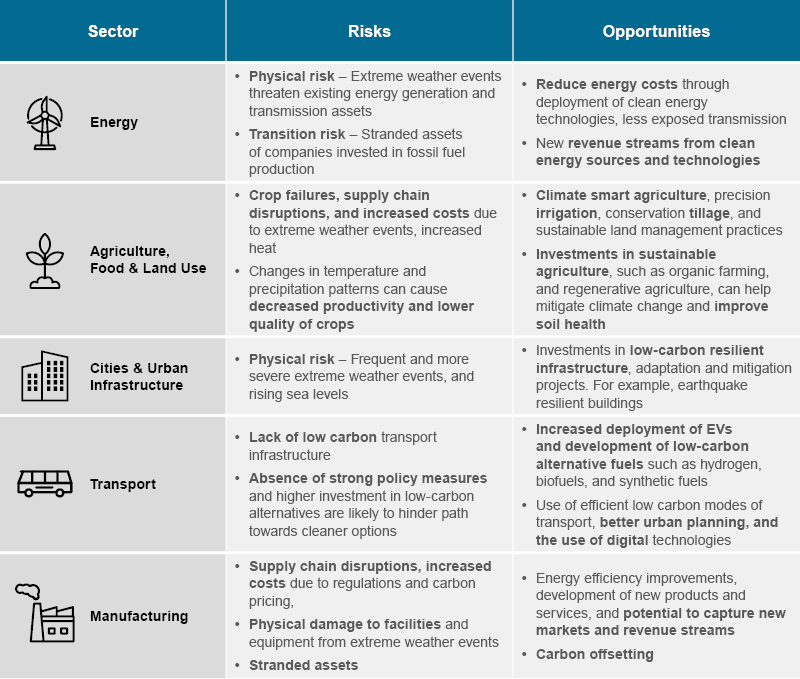

Climate Risks and Opportunities for Financial Institutions

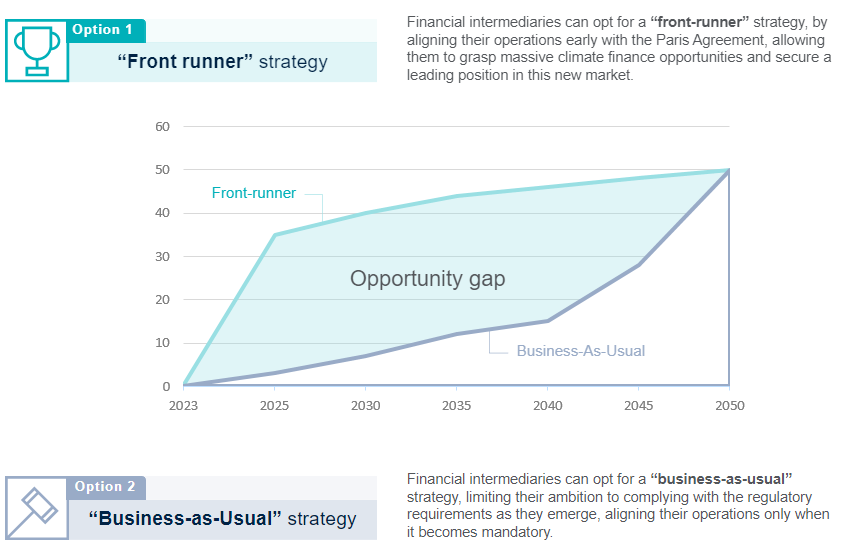

Paris alignment will strengthen relationships with all the stakeholders that banks need for long-term viability and success. All banking stakeholders expect to undergo changes towards more sustainable approaches.

Regulations and Initiatives

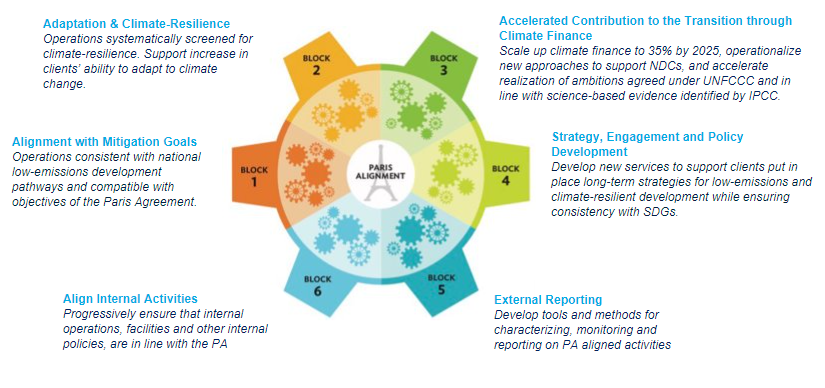

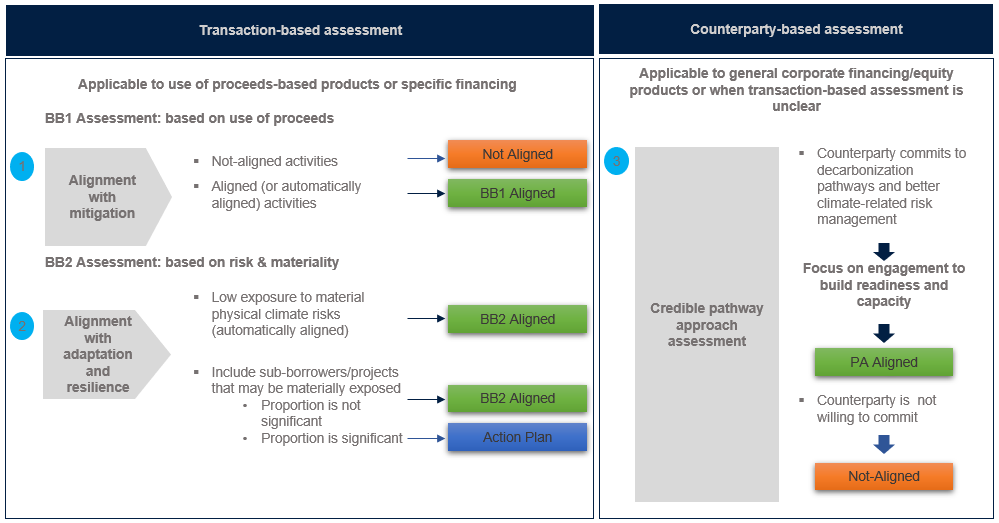

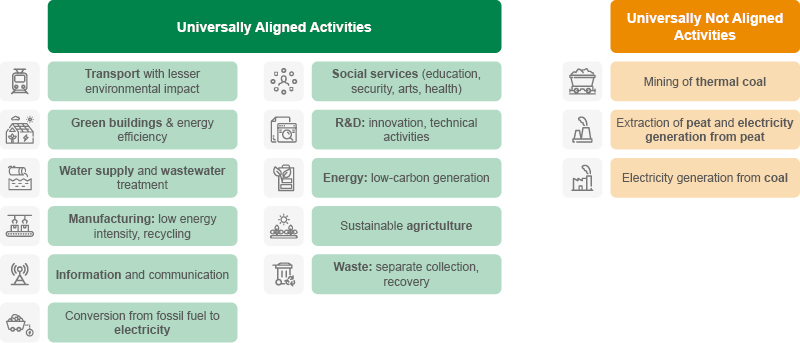

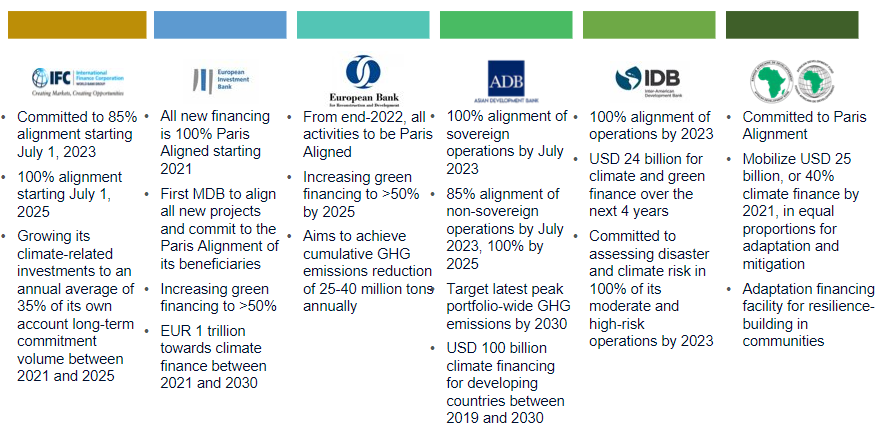

In 2017, MDBs committed to align their financial flows with the goals of the Paris Agreement, and at COP24 they published their Joint Approach, to put that commitment into action. The Joint MDB framework guides each MDB as it develops its own system.

Additional Resources

Below are some additional resources that could be useful.

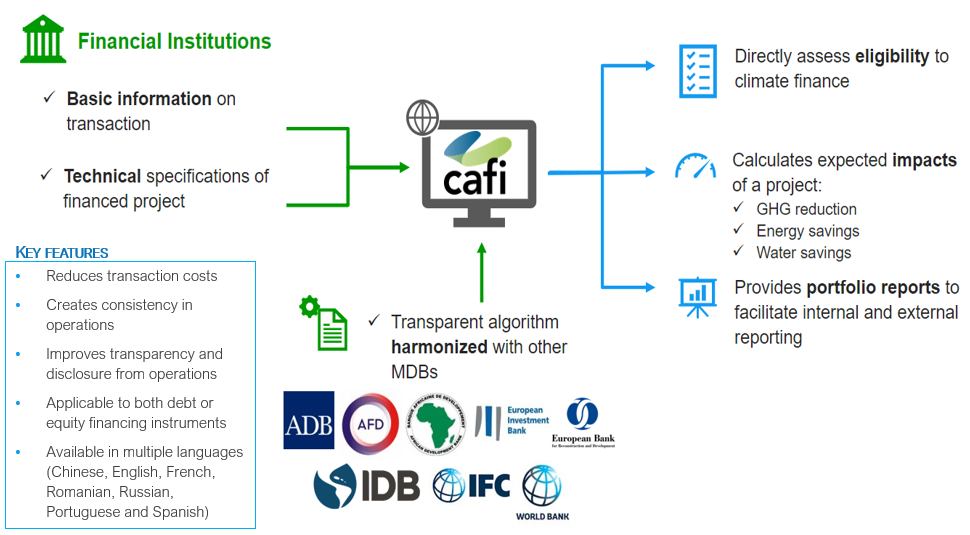

CAFI

CAFI or Climate Assessment for Financial Institutions tool, is a first-of-its-kind leading impact monitoring and reporting tool developed by IFC for climate impact data evaluation. It is a digital, web-based platform that helps financial institutions assess the climate eligibility of their portfolio and measure its development impact.

CAFI or Climate Assessment for Financial Institutions tool, is a first-of-its-kind leading impact monitoring and reporting tool developed by IFC for climate impact data evaluation. It is a digital, web-based platform that helps financial institutions assess the climate eligibility of their portfolio and measure its development impact.

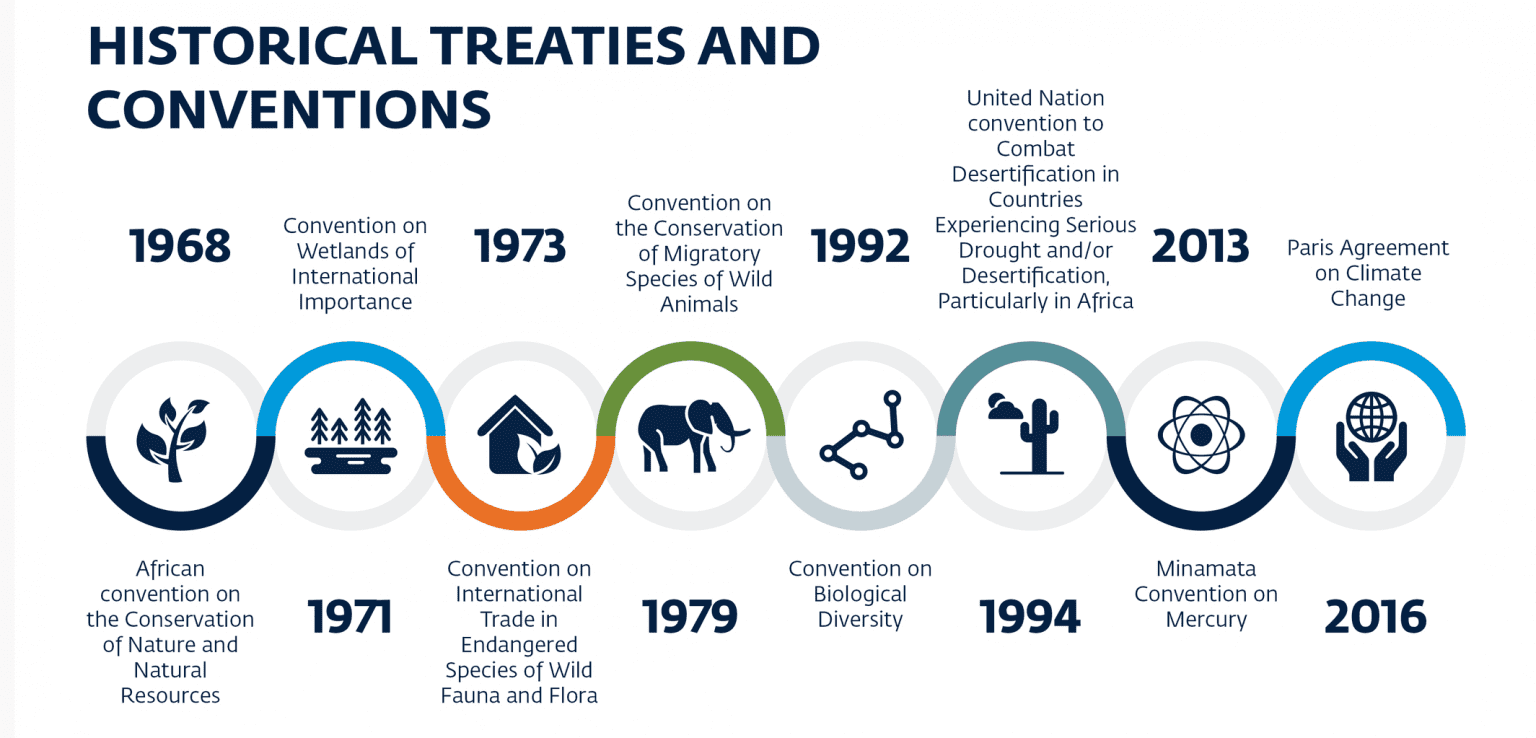

International Conventions and Standards

The activities of clients/investees may be regulated under international conventions and subject to various international sustainability and certifications. A financial institution should be knowledgeable of which of these apply to their clients/investees.

International Conventions and Agreements

The activities of a financial institution's clients/investees may be regulated under international conventions, agreements and bans.

International conventions, agreements and bans have been adopted by governments around the world in the following areas:

International Standards

Various international sustainability standards and industry certifications have been established, which may apply to a financial institution's client/investee.

International industry certifications have been established, for example, for managing the world’s forests and fisheries, encouraging businesses to market products and services that are kinder to the environment, improving the global supply chain, and reducing the environmental impact of production sites.

Regional Initiatives

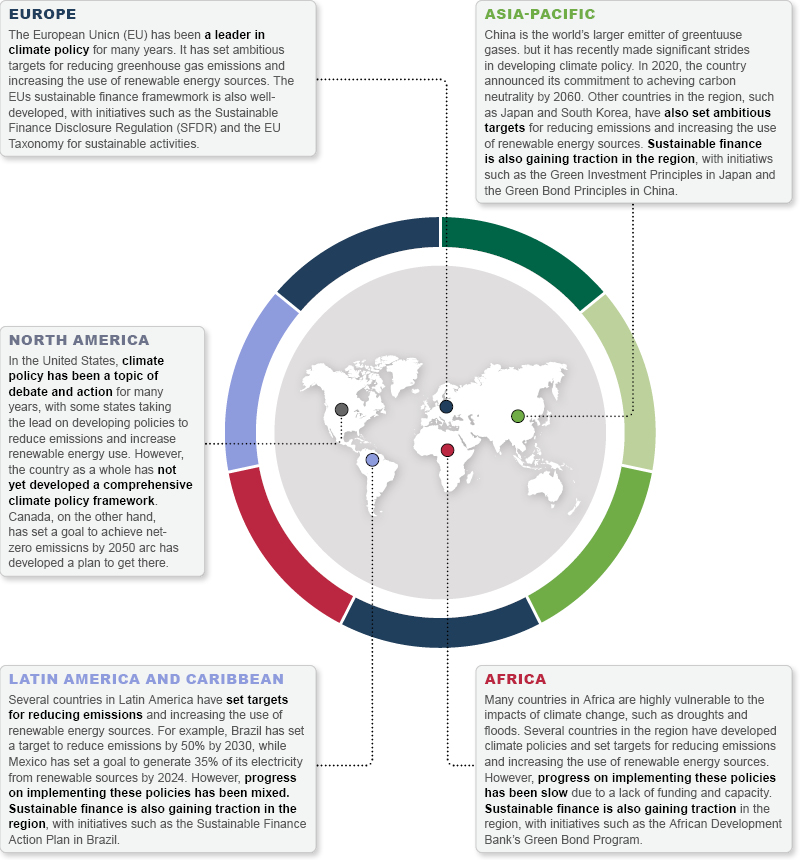

European Union (EU) Initiatives

Sustainable Finance Disclosure Regulation (SFDR) is a European regulation introduced to improve transparency in the market for sustainable investment products, to prevent greenwashing and to increase transparency around sustainability claims made by financial market participants. The SFDR is a fundamental pillar of the EU Sustainable Finance agenda, having been introduced by the European Commission as a core part of its 2018 Sustainable Finance Action Plan, which also include the Taxonomy Regulation and the Low Carbon Benchmarks Regulation.

EU Taxonomy Regulation is a classification system that helps companies and investors identify “environmentally sustainable” economic activities to make sustainable investment decisions. Environmentally sustainable economic activities are described as those which “make a substantial contribution to at least one of the EU’s climate and environmental objectives, while at the same time is not contrary to Do Not Significant Harm (DNSH) principle and meets minimum safeguards.”. Recently, partnership between IFC and the Equator Principles Association has brought important research that explores linkages and provides practical comparisons between the EU Taxonomy’s DNSH and minimum safeguards requirements, and the IFC Performance Standards and World Bank Group Environmental, Health, and Safety (EHS) Guidelines. Link: https://www.ifc.org/en/insights-reports/2023/publications-ifceutaxonomy

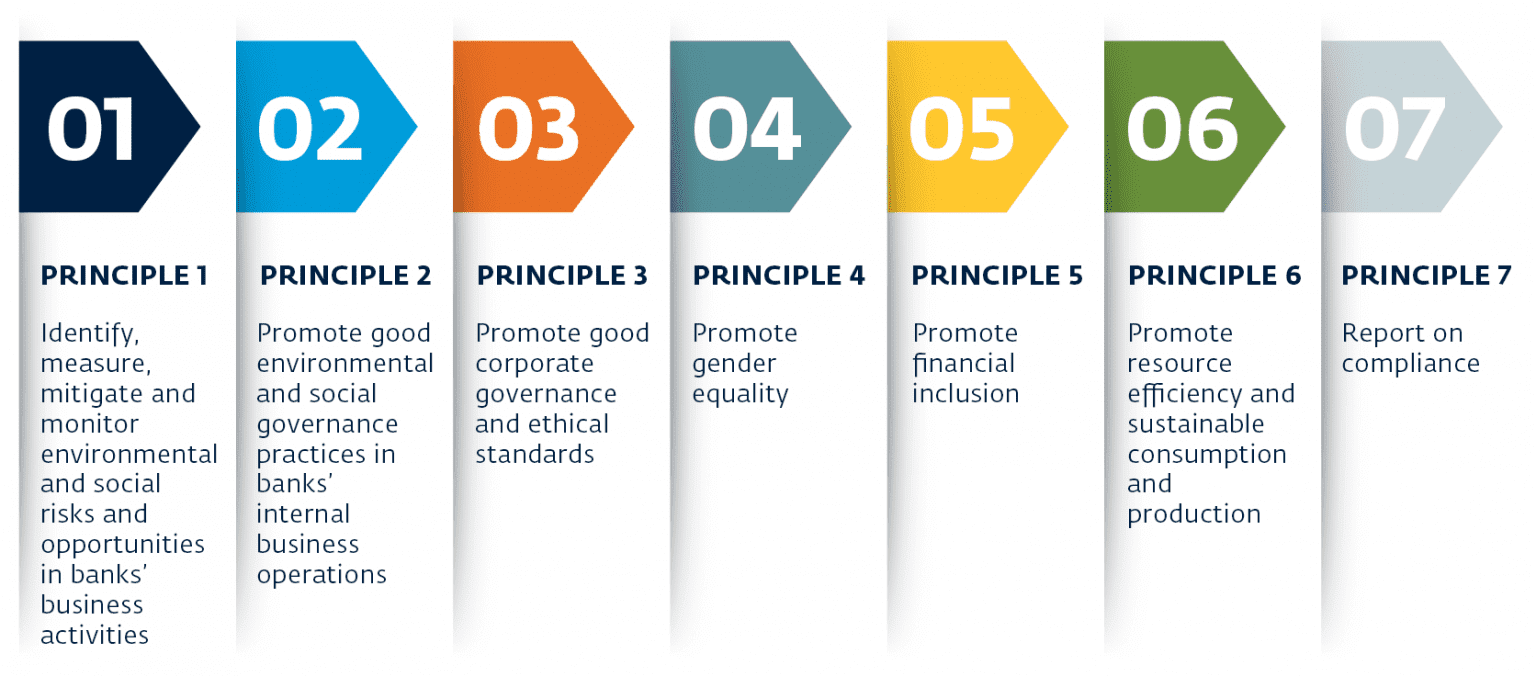

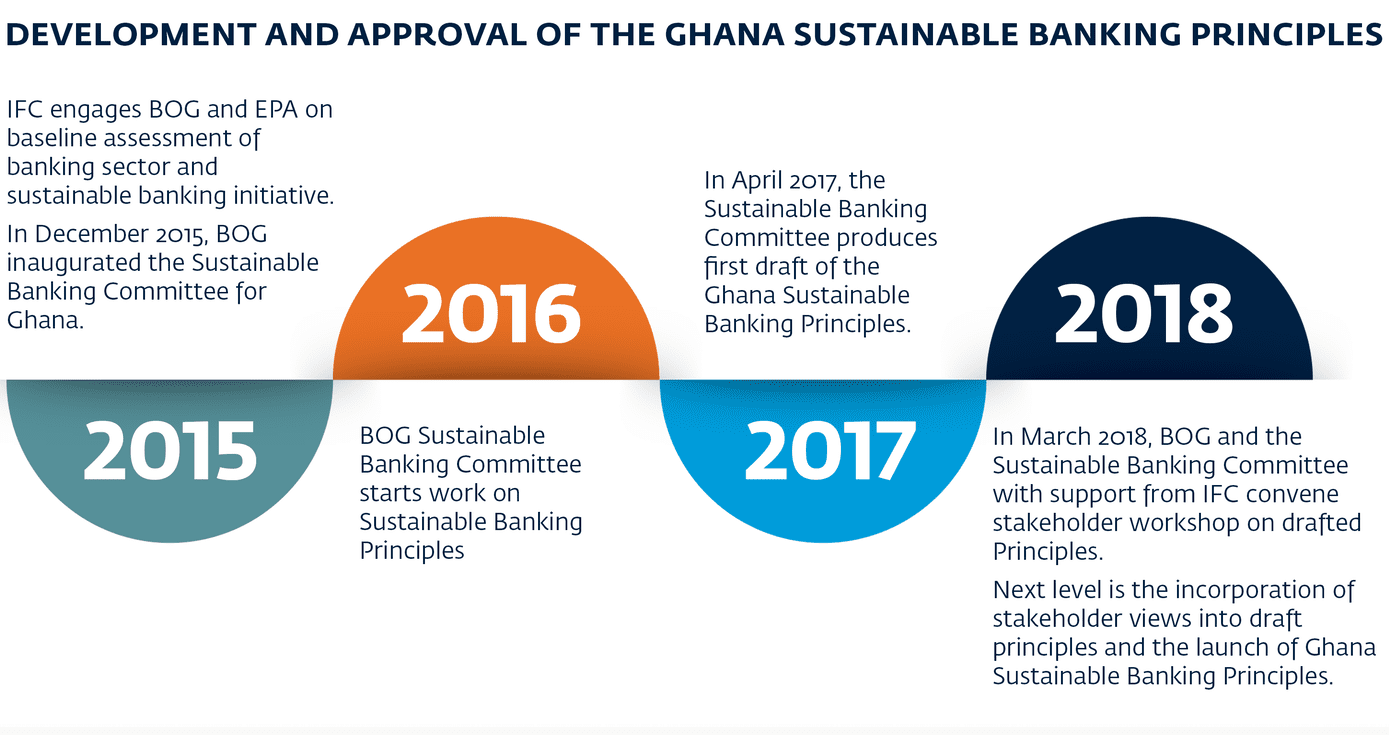

Ghanaian Sustainable Banking Principles

Sustainability In The Ghana Financial Sector

With the environmental and social challenges faced by societies today, conventional business models that do not consider the triple bottom line of people, profit and planet are likely to be unsustainable and uncompetitive. Globally, the financial sector plays a key role in the sustainability conversation and it has introduced various initiatives to encourage integration of environmental and social considerations into financing decisions.

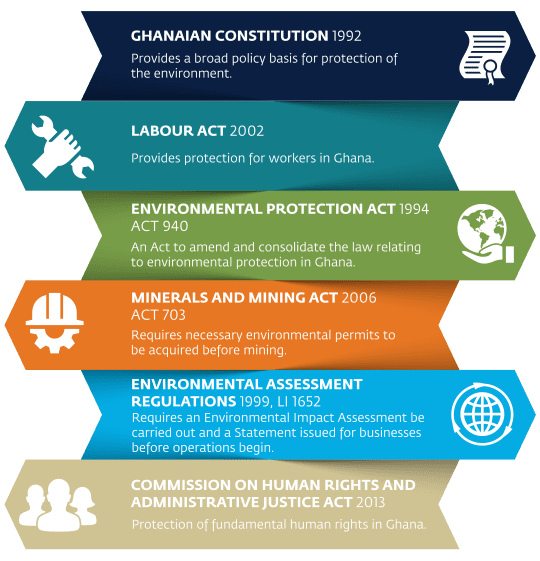

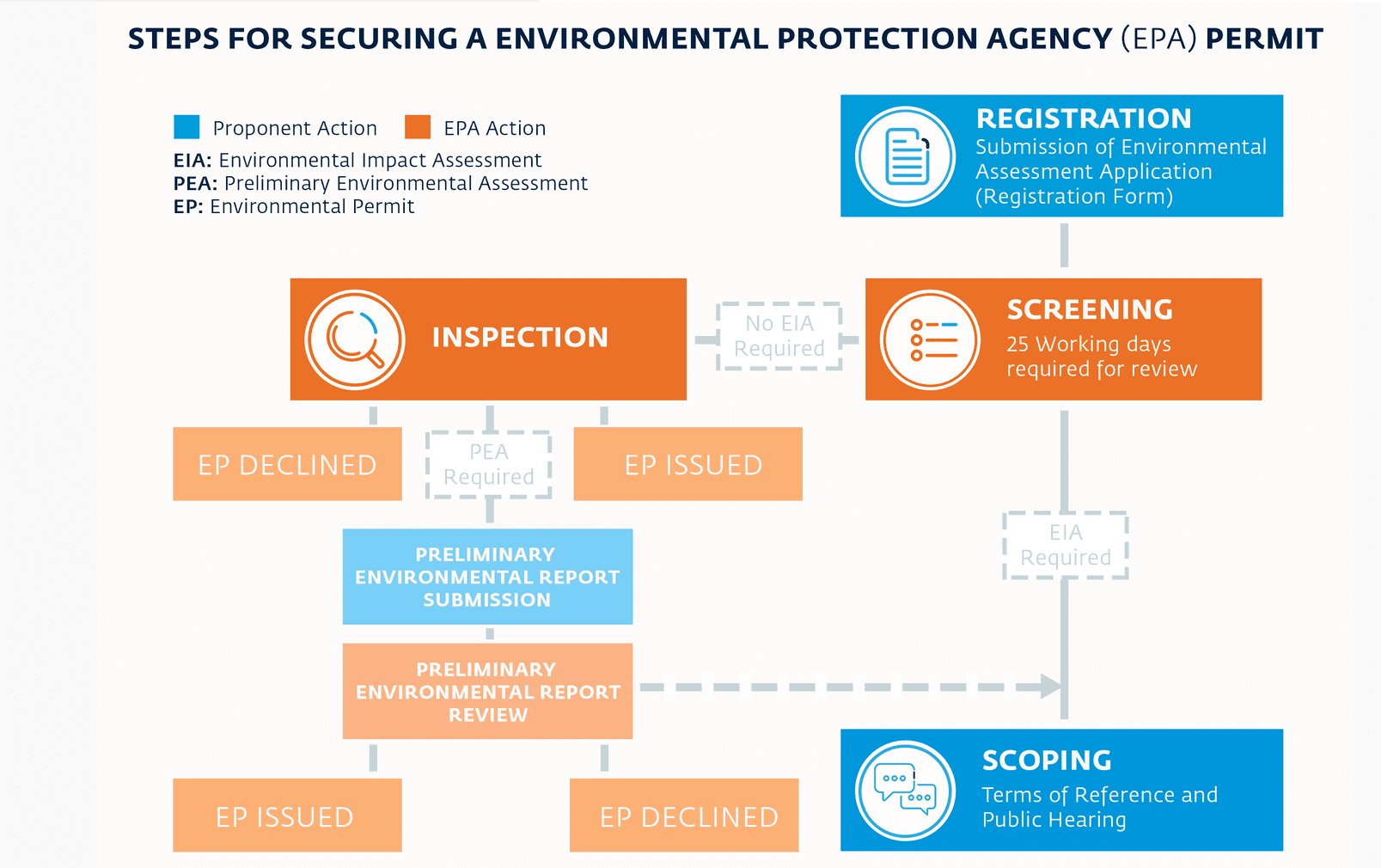

Ghanaian Environmental And Social Laws

Ghana’s economy is highly reliant on climate sensitive sectors such as agriculture, and thus, preservation of the environment, and awareness of social risks is important for a resilient economy. From a regulatory perspective, there are a myriad of regulations in Ghana addressing protection of the environment, and society. It is important for financial institutions to be aware of the pertinent legislation which is applicable to their clients’ businesses, as well as their own operations.

This section presents an overview of key environmental and social legislation, and the coordinating bodies pertinent for financial institutions.

Sustainability In The Nigerian Financial Sector

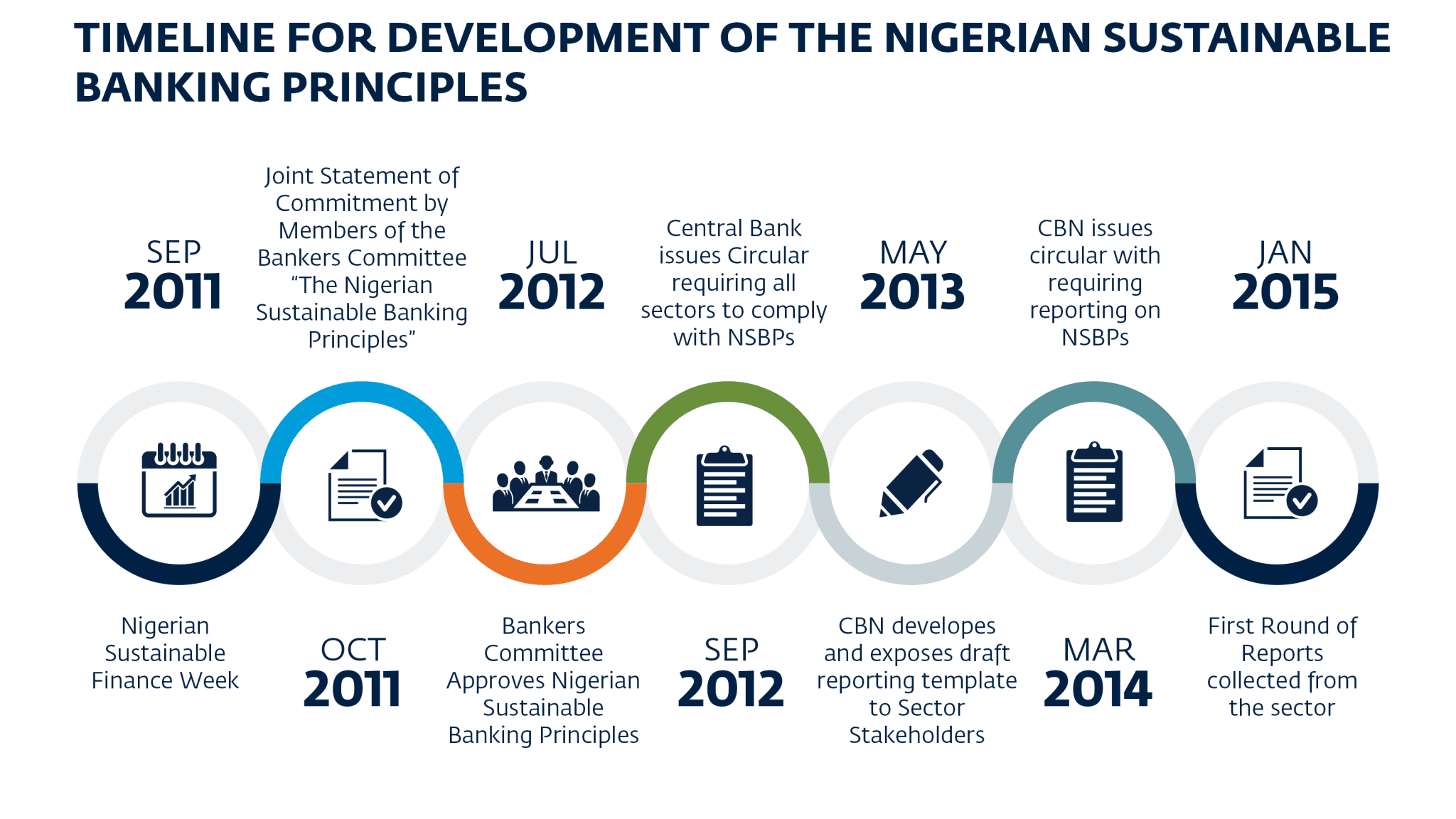

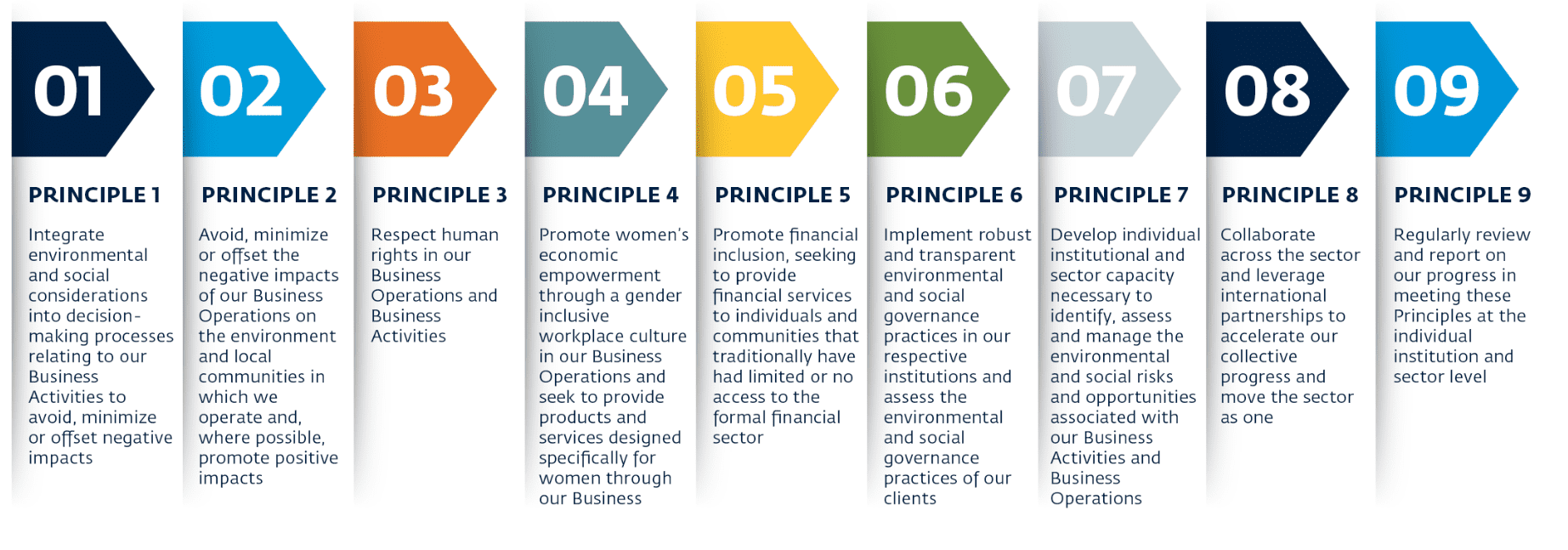

Nigeria’s banking sector plays a significant role in the country’s growth and is critical to the overall development of the economy. Sustainability was initially approached by the sector from a primarily corporate social responsibility (CSR) angle, with financial institutions supporting charitable initiatives and community engagement activities. However, following numerous significant global events such as the 2016 Paris Climate accord, Annual UN Climate Change Summits, and many international financial institutions resorting to green financing, sustainable investing has finally elbowed its way into mainstream financial intermediation.