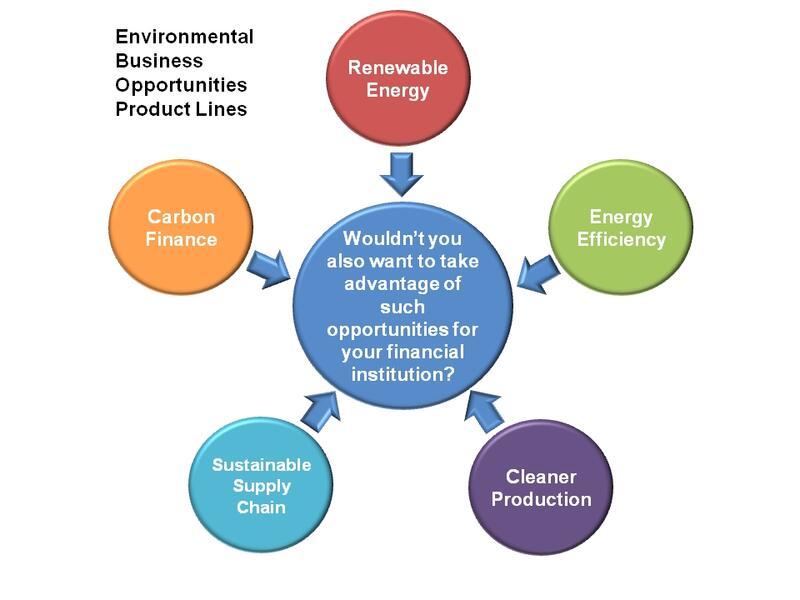

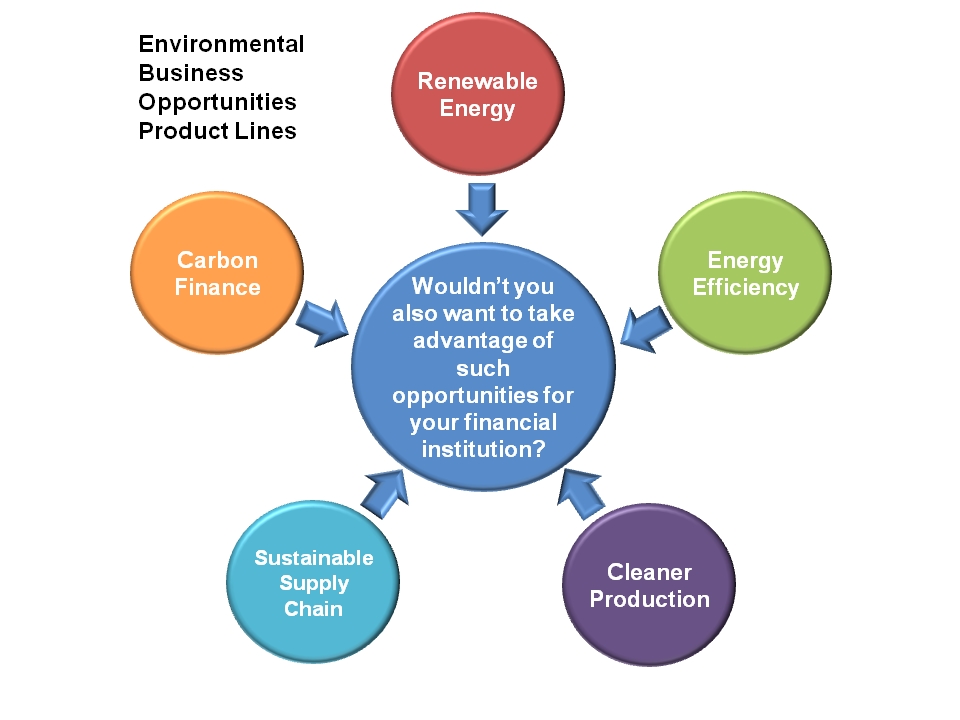

New Environmental Business Opportunities

Environmental and social risk management can help financial institutions identify market demands for new products that address environmental and social sustainability and to create new products accordingly.

Sustainable Business Opportunities Start Here

The products that FIs offer to the market when pursuing Environmental Business Opportunities are no different than traditional financial products. The difference is in how the products are marketed and how the lendees/ investees are incentivized.

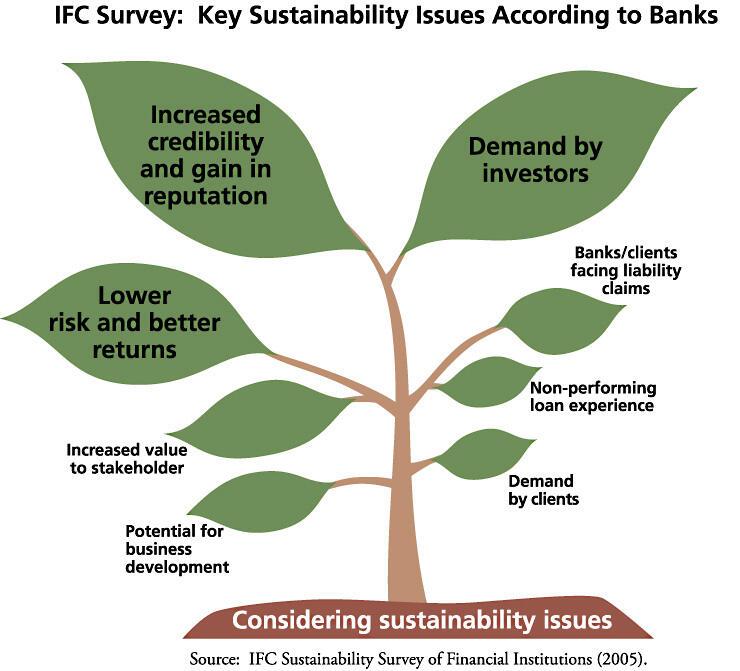

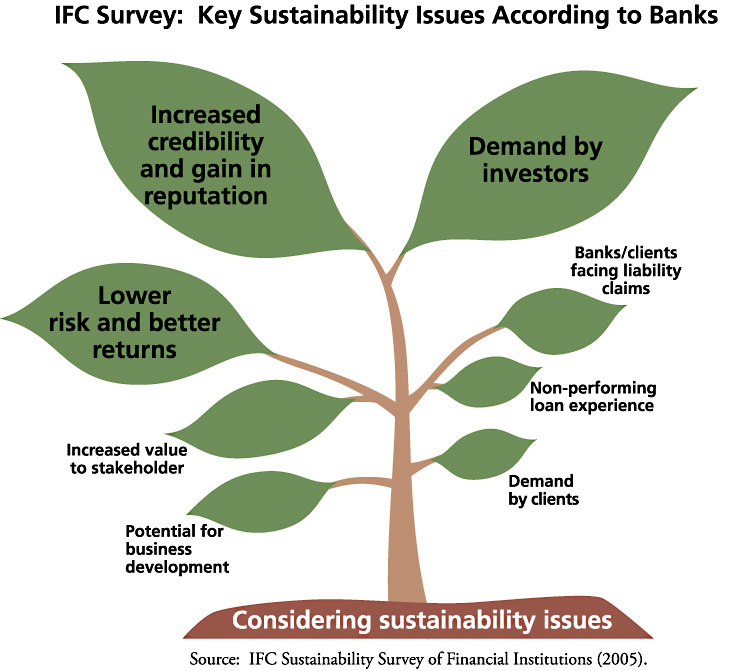

Business Case

The integration of sustainability into management systems and practices brings tangible benefits, including new lines of business, new clients, greater access to financing, greater shareholder value, and improved reputation and goodwill.

According to IFC’s 2007 report Banking on Sustainability, which included a survey of 120 financial institutions in 43 emerging markets, the integration of sustainability into management systems and practices brings tangible benefits, including new lines of business, new clients, greater access to financing, greater shareholder value, and improved reputation and goodwill. Seventy-four percent of the commercial banks in the survey reported a reduction in risk as a result of considering environmental and social issues. Another 48 percent noted improved access to international capital, 39 percent benefited from improved brand value and reputation, 35 percent developed new business, and 26 percent benefited from improved community relations.

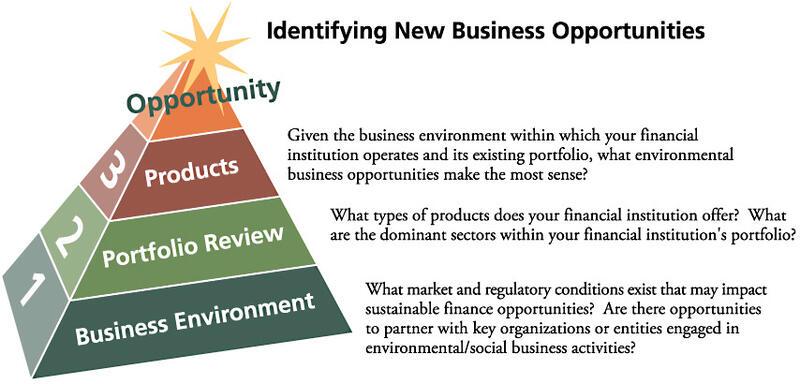

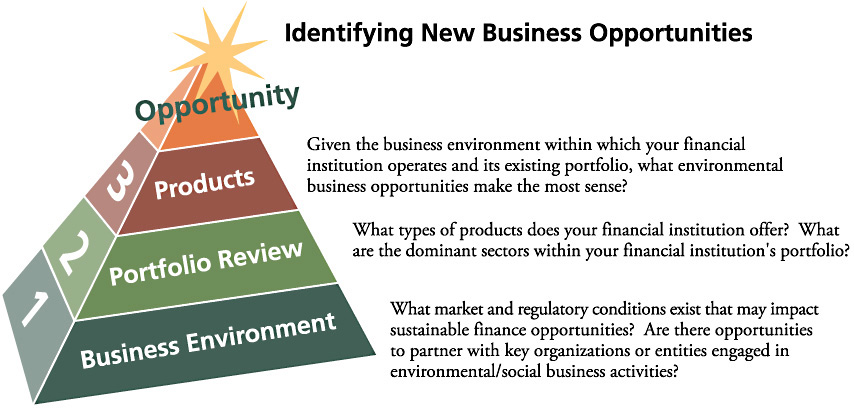

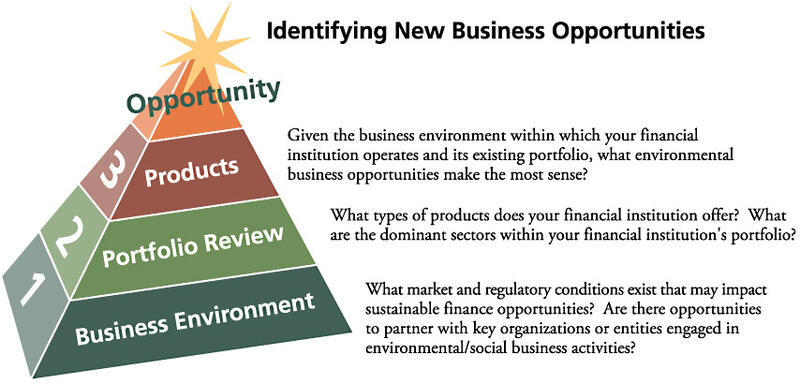

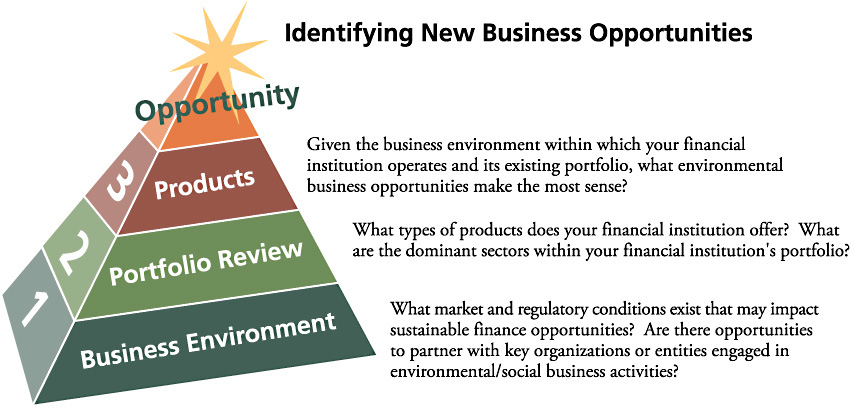

Portfolio Analysis and Market Scoping

FIs will conduct a needs assessment to narrow down the sustainable finance products to determine the most appropriate product to introduce based on the type of lending / investment and the composition of its portfolio clients or investee companies. In addition, FIs will conduct market scoping to analyze market conditions.

Create a Pipeline

FIs can build partnerships to develop a pipeline of new business by engaging with relevant players in the market. Energy Service Companies (ESCOs), technology manufacturers and suppliers and other market aggregators may be interested in partnering with an FI to bring financing to existing or prospective clients.

Case for Sustainable Business Opportunities

Market factors such as resource scarcity and the need to mitigate climate change present an important opportunity for society. Growing demand for financing creates an opportunity for financial institutions (FIs) to expand product offerings to include sustainable financ

Asset Managers

Asset management is the professional management of various securities (shares, bonds and other securities) and assets (e.g., real estate) in order to meet specified investment goals for the benefit of the investors

Commercial Banking

A banking institution (also referred to as a universal or commercial bank) can range from being a large Financial Institution with a highly visible brand name and an international presence to a small organization with a local presence.

Institutional Investors

Institutional investors are organizations that pool large sums of money and invest those sums in securities, real property and other investment assets.

Non-Banking Financial Institutions

Non-Banking Financial Institutions focus on financial transactions other than traditional banking and include: microfinance, leasing, and private equity funds.

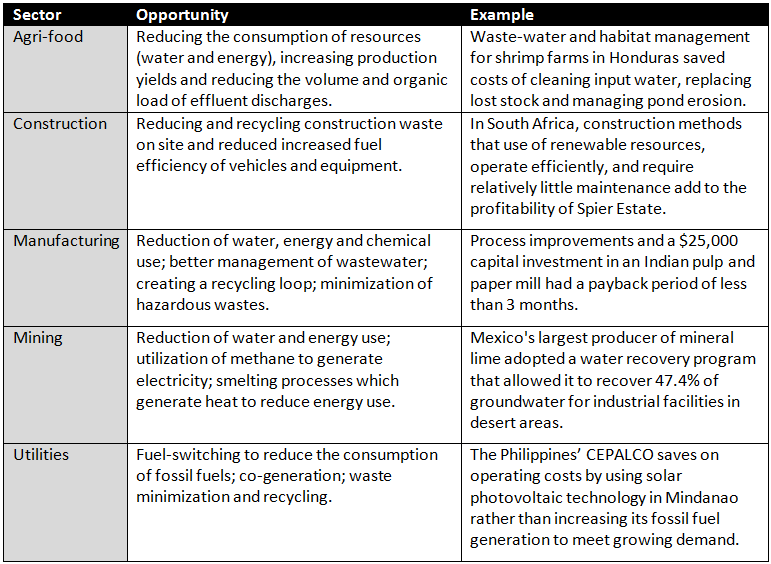

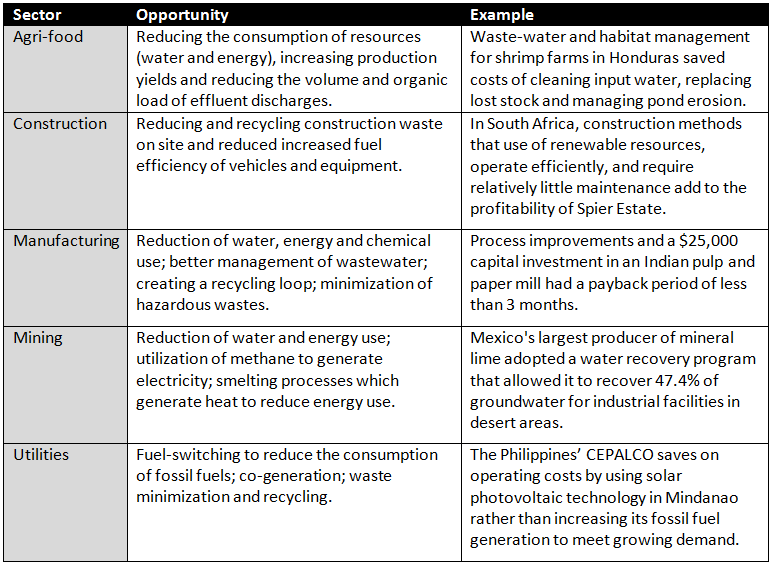

Sustainable Business Opportunities by Industry Sector

Environmental Business Opportunities are often cross-cutting. However, the prioritized opportunities in which an FI may want to lend/invest will vary depending on the industry sector.

Agribusiness and Food Production

The agribusiness and food production sectors are typically resource intensive and present opportunity for operating efficiency improvements.

Chemicals

The chemical sector is resource intensive and presents opportunity for operating efficiency improvements.

Forestry

The forestry sector is typically resource intensive and present opportunity for operating efficiency improvements.

General Manufacturing

The manufacturing sector is typically resource intensive and presents opportunity for operating efficiency improvements.

Infrastructure

The infrastructure sector includes a wide range of activities that vary from medium to high environmental impact. Construction and decommissioning activities are typically resource intensive.

Mining

The mining sector is typically resource intensive and present opportunity for operating efficiency improvements.

Oil and Gas

The oil and gas sector is resource intensive and presents opportunity for operating efficiency improvements.

Power

The power sector is resource intensive and presents opportunity for operating efficiency improvements.

Retail and Services

Overall, the retail and services sector is widely considered to have low impact on natural resources and few environmental issues.

Sustainable Business Opportunities by Type

Financial Institutions (FIs) can address environmental issues faced by portfolio companies by offering various financial products such as credit lines or equity investments conditional on the company meeting eligibility criteria. The first step is to understand the types of environmental opportunities around which FIs can structure their financial offerings.

The opportunities typically require the lendee or investee company to integrate technologies into their operations which will lead to cost savings and operating efficiencies. These technologies may require the purchase of new equipment or may simply require the replacement of inefficient light bulbs or better heating / cooling systems management.

Carbon Finance

Carbon Finance is earned by making investments in generation of greenhouse gas emission reductions that can be traded in carbon markets.

Common Carbon Finance project types include cleaner production projects and projects that increase energy efficiency or generate power from renewable resources. FIs could participate actively in carbon markets in various ways:

Carbon Finance in Australia and Pacific

Australian financial institutions are beginning to capitalize on the opportunity to develop a carbon finance business to compliment the projects they lend or invest in.

Carbon Finance in Europe

European governments have been at the forefront of developing policies and mechanisms to support carbon trading and European financial institutions are increasingly investing in a variety of emission reduction projects eligible under the Kyoto Protocol and the EU Emissions Trading Scheme (EU ETS).

Carbon Finance in Latin America and Caribbean

Latin American and Caribbean financial institutions are expanding their investment solutions' offering to promote innovation in the market and respond to the quest for lower Greenhouse Gas (GHG) emissions.

Carbon Finance in Sub-Saharan Africa

Banks in Sub-Saharan Africa are taking on the role of broker as they increase the number of loans they are making to projects that present potential for generating carbon credits that the bank can buy and sell on the carbon market.

Cleaner Production

Cleaner Production is the introduction of revised processes, management, and housekeeping practices through the business cycle with an emphasis on reducing waste and pollution at the source.

Energy Efficiency

As global demand for energy rises, so will the consequences of climate change. Investments in energy efficiency can generate substantial economic and environmental benefits while promising increasing financial returns.

Energy Efficiency in Asia

Energy efficiency opportunities abound in Asia and FIs are actively pursuing opportunities to finance and invest in this space.

Energy Efficiency in Australia & Pacific

Growing awareness amongst FIs about the potential for financing residential and industrial energy efficiency improvements in Australia & the Pacific.

Energy Efficiency in Europe

Financial institutions have been financing energy efficiency projects in Europe for decades and there are many examples of banks, private equity funds and other investors profiting from performance improvements brought about by energy efficient technology. Here are a few examples:

Energy Efficiency in Latin America and Caribbean

Financial institutions in Latin America and Caribbean are focusing attention on clean energy projects, many of whom are realizing that their portfolio presents a wealth of opportunity to finance energy efficiency projects with existing clients. BBVA was one of the first to tap this potential.

Energy Efficiency in Middle East and North Africa

Energy efficiency opportunities abound in Middle East and North Africa and fund managers are actively pursuing opportunities to finance and invest in this space.

Energy Efficiency in North America

Financial institutions, mainly banks, are actively differentiating their product offerings by making consumer loans available for energy efficiency products. Unique energy efficiency offerings for business loans are emerging as a way to retain existing business clients and attract new clients.

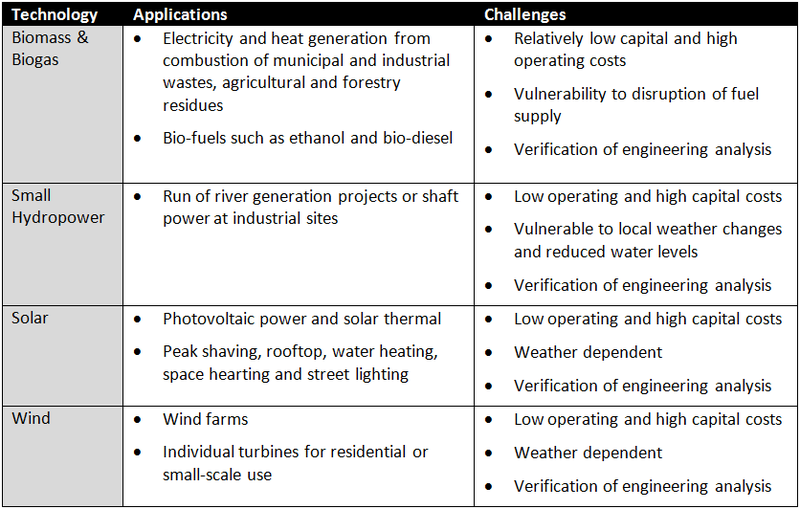

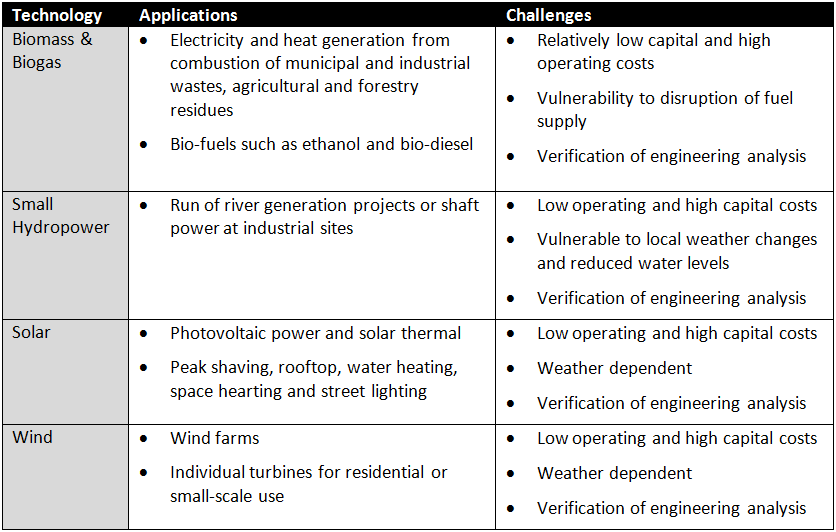

Renewable Energy

Only a few renewable technologies are price-competitive with oil and carbon fuels; however, the pricing gap is decreasing rapidly due to technological advances and the price of fossil fuels. As a result, investments in renewable energy technologies are on the rise and companies are pursuing financing options.

Renewable Energy in Asia

Investment in renewable energy is on the rise in Asia, in particular in the microfinance space where the vast majority of borrowers are without access to electricity from the grid.

Renewable Energy in Europe

European companies have been leading the way on development of renewable energy technologies, governments have implemented progressive policies to support renewable energy as an alternative to traditional fossil fuels, and financial institutions have been global leaders in financing renewable energy projects. Here are a few examples:

Renewable Energy in Latin America and Caribbean

Investment in renewable energy is on the rise in Latin America and Caribbean, in particular in the microfinance space where the vast majority of borrowers are without access to electricity from the grid. Here's a case study of financing a small-scale hydro project in Peru.

Renewable Energy in Middle East and North Africa

Although MENA continues to be the world's richest oil region, Jordan is one of the most energy insecure countries in MENA with limited indigenous energy resources and relies almost entirely on imported resources to meet its' energy needs.

Renewable Energy in North America

North American financial institutions are increasingly integrating Climate Change into their corporate strategies and creating new lending and investment products and services to increase business in the renewable energy and energy efficiency space.

Renewable Energy in Sub-Saharan Africa

Sub-Saharan Africa presents tremendous untapped potential for supplementing fossil fuel use with renewable energy. In urban centers, grid access to electricity is typically unreliable and patchy and most rural communities lack access at all. Therefore, renewable energy can be a reliable alternative to address basic human needs and improve economic development.

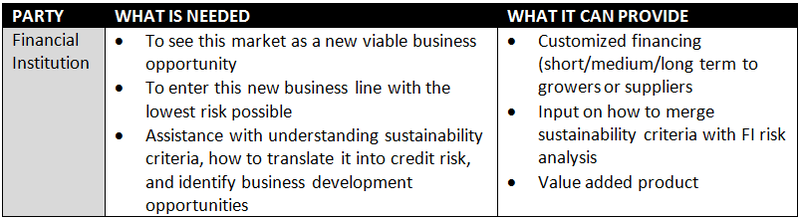

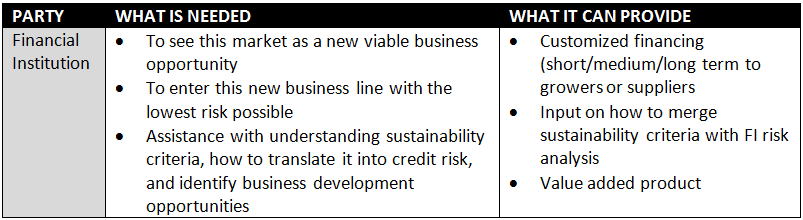

Sustainable Supply Chain

Sustainability in the supply chain has become an increasing area of focus for large companies or off-takers caused by competitive pressures arising from new environmental regulations, labor standards, energy costs, and government and consumer demands.

Competitive pressures triggered by new environmental regulations, labor standards, energy costs, and government and consumer demands are leading many large companies (off-takers) to incorporate sustainability standards into contractual relationships with suppliers to reduce operating risks and ensure profitability and growth. Suppliers able to meet these high value added standards are likely to enjoy increased demand in domestic and import markets and even more competitive pricing.